Price report for Tuesday 23rd April 2024

Power & Gas: Despite gas for power demand increasing for DA, it is expected to reduce thereafter whilst flows from Norway are marginally up and all other supply factors remain unchanged. Power trading in the UK was very sporadic with the trend consistently down from market open. Front month, quarter and season registered over 300mw and 100mw respectively and tracked the bear trend on NBP an TTF.

Carbon: GBP gains on the back of strong UK service sector growth (highest since May 2023) saw EUA and UKA spread widen.

Oil: Softer USD provided value in Brent and support for WTI whilst speculators positioned themselves ahead of US GDP and inflation data publications this week.

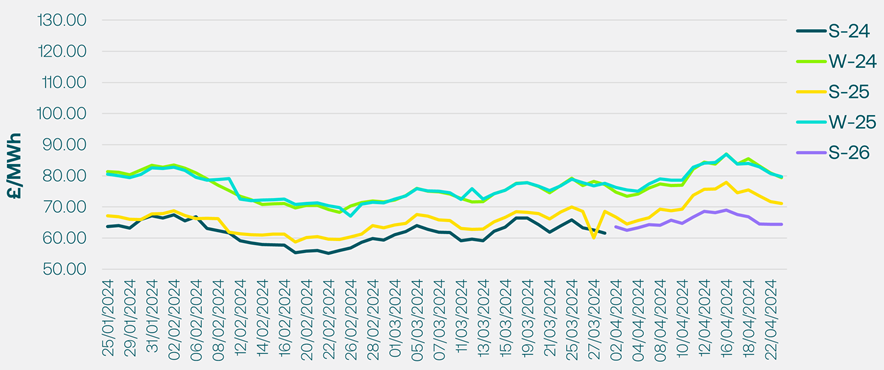

End of Day Seasonal Prices for Tuesday 23rd April 2024

(The above prices were updated 09:30am, 24th April 2024)

Leverage any seasonal price volatility through your Flexible PPA, using SmartFlex, our online trading portal.

> Learn more about our FlexiPPA and SmartFlex

Use your login details to access our End of Day Market Price Reporting Tool for more market prices. To request a customer login, please contact your Account Manager directly.

United States

United States Australia

Australia