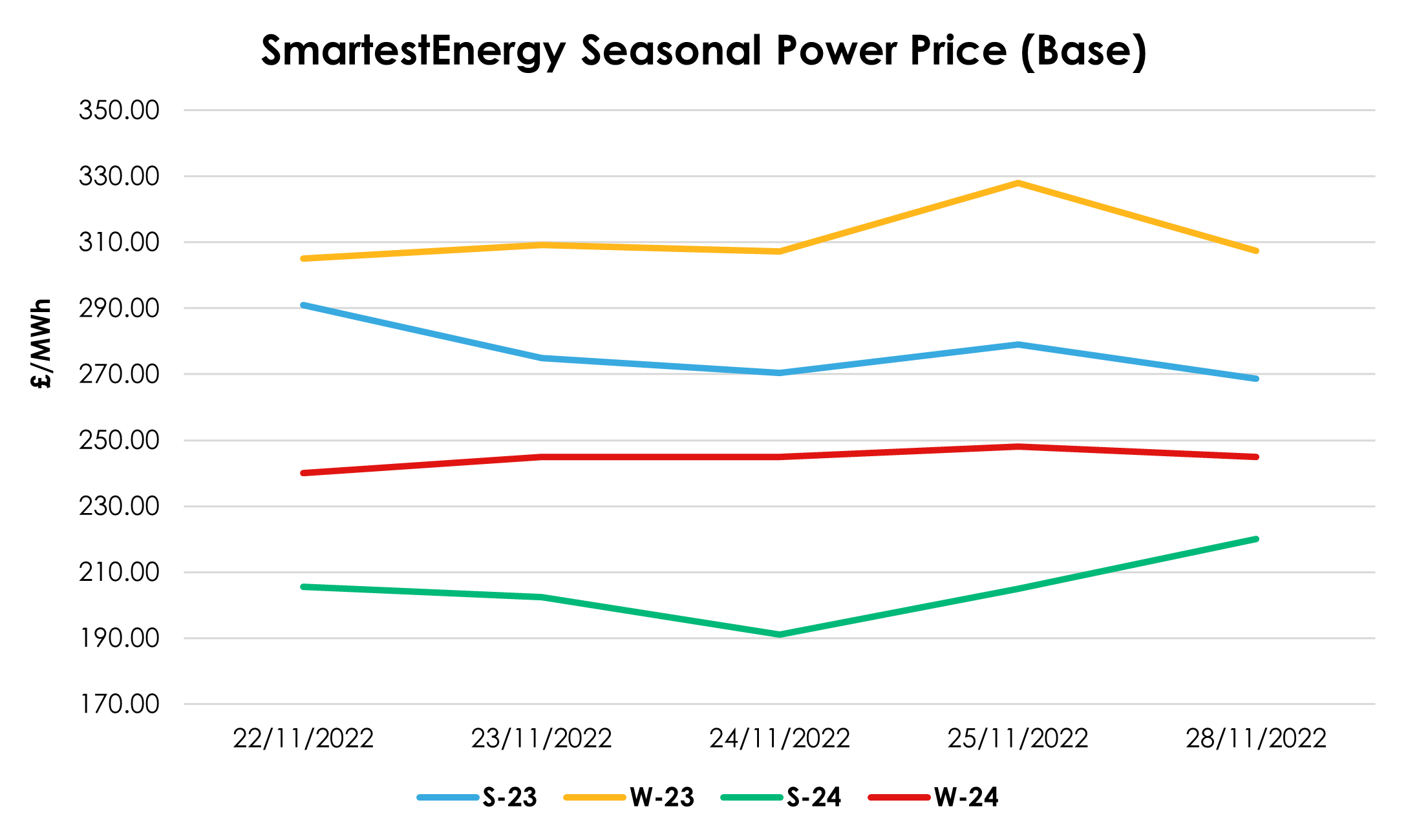

Posted on: 30/11/2022

Head of Sales Trading, Fanos Shiamishis reports on the energy market activity, covering the period 22nd - 29th November 2022. On our end of day pricing tool, the Source, we published an in week high of £290.88/MWh for the Summer-23 seasonal power price on 22nd November with the price decreasing to £268.69/MWh yesterday. In this blog Fanos shares the market news and updates from the last week.

Last week European and UK gas prices rose as we expected colder weather. The EU Commission executive proposed a gas price cap at €275/MWh for month-ahead TTF. The price cap would only take effect if TTF month-ahead was above the cap for two consecutive weeks and if the TTF price was €55/MWh above the LNG reference price for 10 consecutive trading days. However, EU Ministers failed to agree on the proposal stating that the price cap was too high and unlikely to get triggered due to proposed conditions.

Despite expectations of colder weather, EU gas prices fell by the end of the week amid stable supply and good storage. Seasonal norm weather forecast offset the concerns around Russian threats to curb remaining flows via Ukraine. The cost of LNG delivered to northwest Europe jumped 22% to 7-week high, improving the incentive to unload at the regasification terminals. France has approved a revenue cap from nuclear and wind generation at €100/MWh.

On Monday, despite prompt UK gas prices opening stronger in the morning, prices for forward periods traded lower with continental temperatures warmer than Friday’s outlook and steady gas supplies across Europe into next month.

United States

United States Australia

Australia