Exploring the surge in REGO energy prices

In the third and final instalment of our Non-Commodity Costs blog series we take a detailed look at Renewable Energy Guarantee of Origin (REGO) prices from 2019 to 2022. Owen Moulton, C&I Key Account Manager explores the increasing demand and value in REGOs, the reasons that have led to sky-rocketing prices and the importance of certified renewable certificate allocation for business electricity customers.

In the third and final instalment of our Non-Commodity Costs blog series we take a detailed look at Renewable Energy Guarantee of Origin (REGO) prices from 2019 to 2022. Owen Moulton, I&C Key Account Manager explores the increasing demand and value in REGOs, the reasons that have led to sky-rocketing prices and the importance of certified renewable certificate allocation for business electricity customers.

Just like the wholesale market, which is impacted by a number of different factors driving prices up and down, the REGO market is also driven by various market factors and the price of REGOs have dramatically increased over the last few years.

Since we launched the UK’s first certified 100% renewable electricity product, we’ve highlighted the value of REGO certificates, not only for the confidence they give consumers as a credible source of renewable supply but also as an important income stream for independent renewable generation in an energy landscape where low-carbon subsidies and benefits have been removed. With ambitious net-zero targets and the increasing uptake of renewable power for businesses and consumers, the REGO price has risen significantly from 2019-2022, from a relatively flat price, between 30-70p, to prices in the region of £4.00 that we’ve seen more recently. If we take Compliance Period 21 (Apr 22 - March 23), we saw at Mid-REGO price of 0.42 in April 2021 and £4.10 now, an increase of 876%.

What’s driving these high REGO Prices?

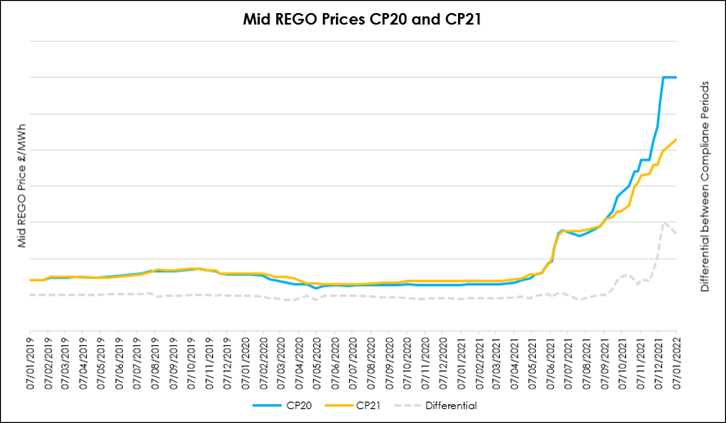

In my recent conversations with our REGO expert, Vishnu Aggarwal, Deputy VP of Origination and Renewable Trading, he explained the latest trends with REGO pricing using the below chart:

As illustrated by the chart, he tracks the compliance periods (CP) spanning 2021/22 (CP20, the blue line) and 2022/23 (CP21, the yellow line). REGO prices tumbled going into the first lockdown in early 2020, before recovering nearly a year later. He mentioned that prices of the nearer term CP20 dipped below CP21 prices, as fears of a sustained near-term demand destruction from the lockdowns ensued. Prices then recovered almost a year later in April-21 and have been on a meteoric rise ever since. This has coincided with normalising demand levels, increasing sustainability commitments from corporates and domestic customers alike. Particularly interesting is the spread opening between the near dated contract CP20 and CP21, because of materially less wind production throughout 2021.

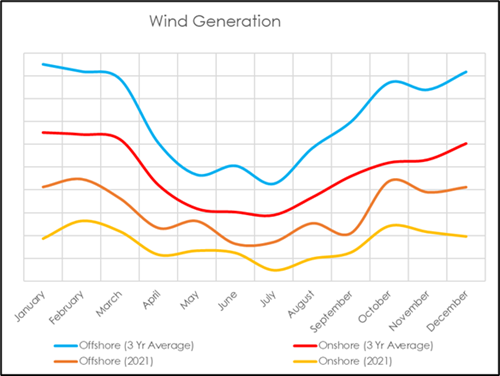

The UK has seen unseasonal low levels of renewable generation with a downward trajectory in March 2021. The lowest point for wind output in 2021 was seen in July (shown in the chart below) where wind only made up only 11% of the UK’s electricity supply, a significant decrease compared to the highest ever share of wind contribution recorded in August 2020 at almost 60%. The intermittent generation alongside a desire to purse "greener" renewable sources has pushed up the premium of natural renewable energy and more expensive compared to baseload prices.

Why is it so important to opt for a certified renewable product?

With a higher demand that renewable output is struggling to keep up with in recent years, certified renewable energy has become a hot commodity!

In December 2021, Ofgem published a list of 20 energy suppliers that “overstated” the share of the renewable electricity in their fuel mix disclosures (FMD) for the period 2019-2020. According to an article by Energy Live News, eleven suppliers were said to have insufficient Renewable Energy Guarantee of Origin (REGO) and/or Guarantee of Origin (GoO) for their 2019/20 FMD statements.

We offer our customers our 100% renewable electricity products that offer unrivalled transparency and are independently certified by the Carbon Trust to confirm that every megawatt hour is backed by UK-recognised renewable certificates. This means our customers can confidently report on their zero carbon emissions using the market-based method in accordance with the Greenhouse Gas (GHG) Protocol Scope 2 Guidance and actively support the growth of independent renewables on the grid.

SmartestEnergy were awarded for our green thinking and product transparency at the Energy Awards in 2018, due to our accreditation and verification processes behind our certified renewable energy products, which launched in 2015. To ensure we have enough REGOs for our customers renewable supply contracts now and in the future, we commission Carbon Trust to complete an annual verification and a quarterly audit, to give our customers the confidence that they will have 100% renewable power for the remaining term of their contract.

Start your net zero journey with our renewable supply

Explore our 100% renewable supply offerings and take the next step no matter where you are on your net zero journey.