Smartest Insight | Issue 105

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

February 3, 2022

Market Update:

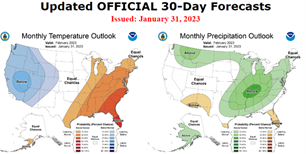

Prompt gas is down $0.30/MMBtu on the week and is now trading at levels we have not seen since April 2021 and the story is primarily weather. January was the warmest on record for the NYISO and ISONE, 61 and 56 HDDs less than previous records respectively (going back to 1960). January was the second warmest on record for PJM, only missing by 4 HDDs. The forecast for February is also expected to be warmer than normal for the eastern half of the US.

Storage for the week ending 1/27/2023 was a draw of 151 Bcf which was ~ 10 Bcf greater than consensus forecasts but was 30 Bcf below the five-year-average. End of season estimates are for storage to be north of 1,900 Bcf which would be 24% above the five-year-average. That combined with robust production, currently averaging 100+ Bcf/day in 2023 have mitigated Freeport’s pending return to service. FERC granted Freeport permission to begin the recommissioning process and Freeport has successfully cooled down its Loop 1 transfer piping, allowing it to move LNG to one of its docks. The work that has been completed and the latest requests potentially put the facility on track to restart operations in February, but most analysts are projecting a March restart. Freeport has a capacity of 2.3 Bcf/Day and accounted for 15% of total US exports prior to the June 2022 incident.

FERC Approves Freeport LNG’s First Step Towards Restart:

On January 26, 2023, Federal Energy Regulatory Commission (“FERC”) approved Freeport LNG’s request to introduce LNG into the plant’s piping system. The procedure is expected to take 11 days and is the first step to returning the export facility to normal operations. FERC said in its order that Freeport must file weekly progress reports and obtain an additional authorization before it can restart the 2BCf/d LNG export plant. Given FERC’s quick order, it is likely that Freeport will return to service in February or early March, meaning a material increase in U.S. LNG exports.

PJM Power Plant Owner Files Bankruptcy:

On January 24, 2023, Heritage Power, an affiliate of GenOn Energy that owns a number of power plants in PJM, filed for bankruptcy. Heritage cited low PJM capacity prices and operational problems during the December PJM price spike. Heritage issued an announcement indicating that entered into an agreement with its lenders that will significantly reduce its’ debt, eliminate unfavorable agreements and establish a more sustainable capital structure.

NYSERDA Receives Proposals For Offshore Wind:

On January 26, the New York State Energy Research & Development Authority (“NYSERDA”) announced that it received more than 100 proposals from six developers in response to its third offshore wind solicitation. In July 2022, NYSERDA asked for proposals for up to 2000MW of offshore wind. The solicitation supports New York’s goal to develop 9,000 megawatts of offshore wind energy by 2035. NYSERDA intends to award winners in the spring. Although the bids are not yet public, some developers made announcements, including:

- Equinor BP announced its proposed 1360MW Beacon Wind 2 wind project, located off the coast of Long Island

- Ørsted Wind and Eversource Energy announced a proposal but did not provide details

- RWE and National Grid announced the proposed the 1300MW Community Offshore Wind project

- Invenergy and energyRe announced the 2100MW Leading Light Wind project

- Rise Light & Power proposed a 1300MW project that would connect to Rise’s Ravenswood natural gas plant in Queens