Smartest Insight | Issue 85

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

May 18, 2022

Market Update:

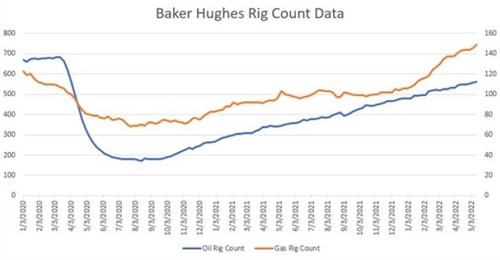

Prompt gas is up ~$1.00/MMBtu over the last week and this has led to increased daily volatility. $0.50 - $0.75 daily ranges are now common. There might be a light at the end of the tunnel (and it is not an oncoming train). Rig counts have picked up over the last several months (chart to the below):

Rig counts are a leading indicator as production increases typically follow 6 to 12 months. This aligns with the most recent EIA Short-term Energy outlook forecast that production will increase to 96-97 Bcf for the second half of the year. If production reaches those levels and is sustained some pressure will be released from the market as supply concerns will be eased. PJM released their summer 2022 forecast for demand and stated that it has enough supply to meet demand. According to the forecast, PJM is prepared to serve a forecasted summer peak demand for electricity of approximately 149,000 MW but has performed reliability studies at even higher loads in excess of 157,000 MW. PJM has approximately 185,000 MW of installed generating capacity available to meet customer needs, with sufficient resources available in reserve to cover generation that is unexpectedly unavailable or for other unanticipated changes in demand. In preparation for summer, PJM has worked with transmission and generation owners throughout the spring to ensure that critical maintenance and system improvements were completed. To stay ahead of any fuel-related supply chain concerns, PJM continues to conduct fuel inventories every two weeks and monitor results for the generation fleet. Since the winter, the organization has seen coal inventories begin to replenish.

Regulatory Report:

PJM updates capacity parameters

On May 11, 2022, at its Market Implementation Committee meeting, PJM recommended changes to certain parameters that underpin its capacity auction clearing methodology. The proposed changes are part of PJMs’ quadrennial review process, where it reviews capacity market parameters every four years. PJM is proposing revisions to the Cost of New Entry (“CONE”), the shape of the capacity demand curve and the methodology for netting revenues from energy and ancillary services. The changes to CONE and the demand curve are expected to be bullish, while the offset methodology is expected to be bearish given the rise in forward energy prices. PJM expects the revised parameters to be voted on in August, approved by the PJM board in September and then filed with the Federal Energy Regulatory Commission (“FERC”) for approval.

FERC accepts NYISO capacity market changes

On May 10, 2022, the Federal Energy Regulatory Commission (“FERC”) accepted capacity market changes for renewable energy generators proposed by the NYISO. The new rules provide an exemption from buyer-side mitigation rules for renewable energy facilities and change the methodology for valuing the capacity contributions of all generators. Under the revised accreditation methodology, NYISO will recalculate the amount of capacity that each generator provides to the grid. These changes will reduce the volume of capacity that renewable generators can sell, as compared to this existing methodology. It appears that FERC made the new methodology effective May 11, so it will likely be effective during the next NYISO auctions.

PJM releases "Grid of the Future" report

On May 10, 2022, PJM issued its “Grid of the Future” report, which envisions a transmission system driven by decarbonization, renewables, public policy, a diverse resource mix and new technologies. PJM anticipates that over the next several years, it will integrate more than 100,000 MW of onshore wind, offshore wind, solar and storage, which are estimated to result in more than $3 billon in grid upgrades. The report identifies four industry trends driving future grid expansion, including generation development/retirement, evolving load characteristics, emerging transmission technologies and resilience. PJM allocates a portion of transmission expansion costs to generators at the time of interconnection. The remainder is paid for over time by energy suppliers, and ultimately borne by customers, in the form of Network Integration Transmission Charges (“NITS”) and Transmission Enhancement Charges (“TECs”).

Company News:

We are excited to announce SmartestEnergy is running a Broker Appreciation sales promotion!

With market volatility, changing market dynamics, and supplier defaults affecting your business, SmartestEnergy wants to help lessen

the impact!

So, we are running the Broker Appreciation sales promotion from May 13th 2022 - May 31st 2022. Additional commission payments can be earned on signed agreements with Smartest based on contracted volume, any start. Commissions will be paid in June 2022. The highest tier achieved will be paid out.

Reach out to your Channel Partner Manager for all the details!