Smartest Insight | Issue 86

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

June 2, 2022

Market Update:

The EIA storage report for the week ending 5/27/2022 was an injection of 90 Bcf which was above consensus estimates of 84 – 86 Bcf. This has cooled a feverish run to just over $9.00 MMBtu, currently the front month is sitting right around $8.50/MMbtu, off about $0.20 from yesterday’s settle. On the power side the NYISO and ISONE have both released their summer assessments and like PJM they see adequate reserves to meet peak summer demand. The eastern regions of the country are in much better shape to meet summer demand compared to our friends west of the Mississippi. NERC released their own Summer Reliability Assessment and they see multiple regions that are at either high risk or elevated risk of blackouts. This is due primarily to drought conditions and resource retirements.

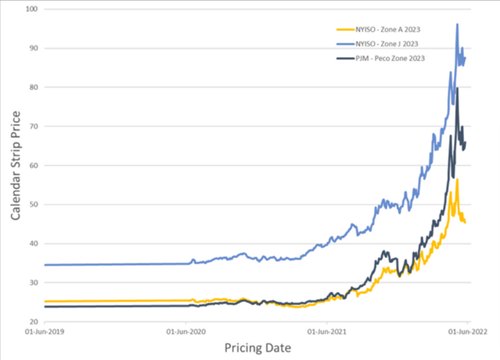

3 year view of the calendar strip price

Regulatory Report:

NYISO CONCERNED ABOUT LOW 2023 RESERVE MARGINS IN NYC

On May 27, 2022, the NYISO announced its expectation that electricity supplies will be sufficient to meet summer projected demand but cautioned that reserve margins might decrease the concerning levels beginning in 2023. NYISO expects a summer peak of 31,765MW compared with available generating capacity of 41,049MW. NYISO’s concern for reserve margins beginning next year stems from the New York State Department of Environmental Conservation’s (NYSDEC”) “Peaker rule”.The Peaker rule, which is designed to limit NOx emissions from power plants near New York City during the summer ozone season, starts to phase in emissions limits during the summer 2023. As a result, power plant owners located in or near New York City are required to either retire or invest significant dollars to comply. Earlier this year, NRG announced that it would retire 558MW of generation at its Astoria facility in Queens. The Peaker rule has had a material impact on New York City capacity prices beginning for summer 2023 and beyond.

FERC STAFF RELEASES 2022 SUMMER OUTLOOK

On May 19, the staff of the Federal Energy Regulatory Commission (”FERC”) published its assessment of the 2022 summer energy markets. Key findings are:

- Growing demand for natural gas, including LNG exports, is expected to outpace the growth in supply, with natural gas prices expected to be higher than last summer. Specifically, the Henry Hub futures contract price is averaging $7.06/MMBtu for June 2022 through September 2022. Total U.S. dry natural gas production is expected to rise this summer by 3.4% compared to summer 2021, while total natural gas demand is expected to rise 4.8%.

- Forecasted hotter temperatures, slightly increased electricity demand, and higher natural gas prices indicate higher prices in wholesale electric markets for the summer—with futures prices for major electricity trading hubs between 77% and 233% higher than last year.

- Despite higher demand, electric markets are expected to have sufficient capacity to maintain adequate reserve margins and electric grid reliability this summer during normal conditions.

- However, extreme operating conditions such as major heat waves, wildfires, hurricanes, and other severe weather events may stress operations. These risks are particularly acute in the West, Texas and parts of the Midwest.

- Effects of world events on U.S. energy prices, beyond those already internalized by the markets, will depend, in part, on how the war in the Ukraine progresses and how market participants adjust to supply and demand changes. For example, U.S. energy sector participants may continue to expand production and export supplies needed globally, such as LNG.

Company News:

June 1st being the first day of the capability period, SmartestEnergy will be launching our Peak Alerts email to keep all of our brokers and customers in the know!

We will be sending alerts out when the probability of a peak day is 70% or higher. This will help your customers plan accordingly to best manage their energy use on these days. If you, or any of your customers, are interested in receiving our alerts email us at [email protected] or reach out directly to your CPM for more information.

We look forward to getting this information out to you and your customers in a continued effort to enhance our service to our partners!