Smartest Insight | Issue 87

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

June 9, 2022

Market Update:

Yesterday was a day to remember in the market. After reaching 2022 intraday highs, the NYMEX July contract fell over $1 on the news of an explosion at the Freeport LNG facility. Gas ultimately ended up down $0.60 on the day to settle $8.699. Late in the day news emerged that the Freeport LNG facility would be offline for a minimum of three weeks, on the news the July contract shed another $0.40. Freeport’s LNG Feedgas demand capacity is 2Bcf/day so each week it is offline equates to 14Bcf/week that could be added to storage but there are bullish crosscurrents. ERCOT is expected to exceed previous record demand set back in August of 2019 this Friday as forecasted load is above 76,000 MWs.

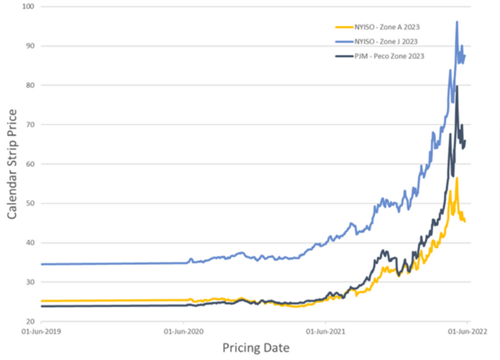

3 year view of the calendar strip price

Regulatory Report:

FERC ACCEPTS ELIMINATION OF MOPR IN ISO-NE

On May 27, 2022, the Federal Energy Regulatory Commission (“FERC”) accepted a proposal filed by ISO-NE to eliminate the Minimum Offer Price Rule (“MOPR”), as used in ISO-NE’s capacity market, effective after a two year transition period. MOPR requires state subsidized generators to submit inflated offer prices into ISO administered capacity auctions, essentially preventing the generators from participating in the capacity markets. In March 2022, ISO-NE filed a proposal to eliminate MOPR starting with the 2028/2029 planning year auction, which will be conducted in February 2025. As part of its proposal, ISO-NE is allowing a MOPR exemption for 300MW of state sponsored renewable capacity for the 2026/2027 capacity auction and 400W of state sponsored renewable capacity for the 2027/2028 capacity auction. FERC has previously approved proposals by NYISO and PJM to eliminate MOPR, albeit without the transition period.

MARYLAND OREC OBLIGATION MOVED TO UTILITIES

On May 29, 2022, Maryland Senate Bill SB526 became law without the governors signature. SB526 removes the obligation on electricity suppliers to purchase Offshore Wind Renewable Energy Credits (“ORECs”).Instead, the bill requires utilities to procure ORECs and recover the associated costs through a nonbypassable charge on utility delivery bills. Marwind, a 270MW project owned by US Wind and anticipated to being commercial operation in 2024, will be Maryland’s first operating offshore wind project.

RGGI is a joint cap-and-trade program committed to reducing carbon dioxide emissions from power plants in eleven states: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey New York, Rhode Island, Vermont and Virginia.Power plants in RGGI states are required to purchase and retire allowances for each ton of CO2 emitted.As a result, plant owners include the cost of RGGI allowances in their energy price offers. At its current price of $1/ton, RGGI allowances add between $6.00-$7.00/MWh to the cost of a natural gas plant.

RGGI CO2 AUCTION CLEARS AT RECORD HIGH PRICE

On June 1, 2022, the Regional Greenhouse Gas Initiative (“RGGI”) conducted an auction for CO2 allowances and the price cleared at a record high 13.90 per ton. The clearing price was 3% higher than the result from the last RGGI auction, conducted in March 2022. A contributor to higher prices is the expectation that CO2 emissions will be higher this year due to higher coal generation resulting from higher natural gas prices. RGGI is a joint cap-and-trade program committed to reducing carbon dioxide emissions from power plants in eleven states: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey New York, Rhode Island, Vermont and Virginia. Pennsylvania is expected to join RGGI in July. Power plants in RGGI states are required to purchase and retire allowances for each ton of CO2 emitted. As a result, plant owners include the cost of RGGI allowances in their energy price offers. At its current price of $13.90/ton, RGGI allowances add between $6.50-$7.50/MWh to the cost of a natural gas plant.

NYSERDA AWARDS CONTRACTS FOR TIER 1 RECS

On June 2, 2022, the New York State Energy Research & Development Authority (“NYSERDA”) awarded Tier 1 REC contracts to 22 renewable energy projects totaling 2400mw. All of the awarded projects are solar projects, with 6 having energy storage capability co-located. All of the awards include an “indexed REC” contract structure, where NYSERDA will pay the project for RECs generated using a formula rate that fluctuates as the cost of electricity fluctuates. NYSERDA reported that the weighted average cost of being paid to the winners is $63.08/MWh over the life of the contracts. NYSERDA charges energy suppliers for these REC costs, which are ultimately passed on to customers.