Smartest Insight | Issue 90

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

July 8, 2022

Market Update:

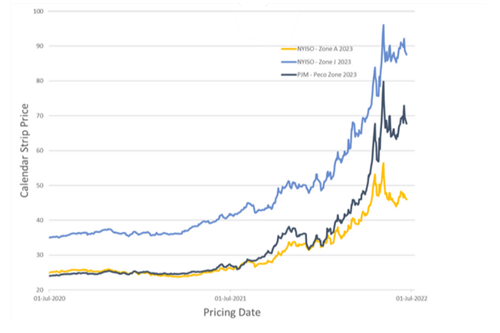

Yesterday saw a much lower than expected storage injection for the week ending 7/1. The EIA reported a net injection of 60 Bcf which was 8 – 10 Bcf below the low end of the forecast. Prompt Nymex was already up around $0.25 on the day prior to the release of the report and then quickly shot up another $0.50 on the news. The prompt contract is back above $6 and currently trading around $6.25. This has had a dramatic impact on the power markets which are trading up $10+ in the bal-22 to winter 23 timeframe. Winter Mass Hub and Eastern NY Zones F-J are the strongest movers as the news today piggybacks off the renewed concerns in the European power and gas markets. The Cal 23 strip for both France and Germany is now around €400/MWh, this comes as Germany is preparing a €9+ Billion bailout package for Uniper, Germany’s largest importer of Russian gas and France is nationalizing EDF. On the US front multiple grid operators are dealing with record load levels. SPP set a new record on 7/5/2022 of 51.1 GW, breaking the old record set a year ago by 63 MWs. Not to be outdone, ERCOT set a new record on 7/5/2022 of 77.5 GW, breaking the old record by 0.9 GW set just last month.

3 year view of the calendar strip price

Regulatory Report:

US SUPREME COURT’S EPA RULING

On June 30, 2022, the US Supreme Court issued a ruling restricting the Environmental Protection Agency’s (“EPA”) ability to regulate emissions from power plants. The Court ruled 6-3, along ideological lines, that U.S. courts should not defer to federal agencies on matters of vast economic significance unless congress has given specific authority to the agency.

As a result, the court struck down the Clean Power Plan that the EPA put in place during the Obama administration. Although a divided congress is unlikely to provide the EPA with the authority envisioned by the Court, the decarbonization of the grid will continue to be driven by state programs and market forces.

FREEPORT LNG STATUS

On June 30, 2022, the Pipeline and Hazardous Materials Safety Administration (“PHMSA”), a federal agency, issued a “notice of proposed safety order”, that defined what Freeport must to before its’ terminal may return to service. Freeport has 30 days to respond to the proposed safety order. Freeport expects to resume partial operations in October and full operations by year end. PHMSA must approve the restart of the terminal. Freeport has the capacity to liquify and export 2 BCf/d, so its status has a material impact on the U.S. gas market.

Company News:

After months of hard work SmartestEnergy US has a new look to our website.

We put a lot of time into creating a more user friendly interface. You will notice some new categories to explore and hopefully will be able to more easily access all the Smartest information you need.

You can now also reference past weeks newsletters in our "Knowledge Hub" archive. So, take a look and revisit any topics of interest!