Posted on: 17/05/2019

After the launch of our 2019 Energy Entrepreneurs Report this week, in the first of a three-part series, Chief Commercial Officer, Dave Cockshott explores the findings for the renewables sector, as well as what the future holds for project developers.

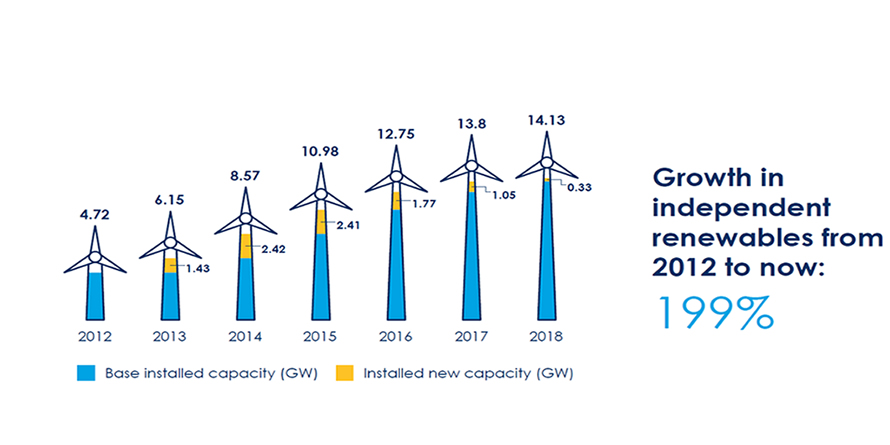

The expansion of the independent renewable energy generation sector over the past seven years has been truly remarkable. Back in 2012, there was only 4.7GW of capacity contributing to Great Britain’s decarbonisation efforts, but now that figure has risen to a staggering 14.1GW.

This comes despite the fact that the independent renewable generation sector has experienced a significant slowdown in the face of subsidy cuts, evident in the closing of the Renewables Obligation and Feed-in Tariff scheme. That said, £158m was still invested in the building of more than one new project a week during the year, taking the total investment over the period more than £3bn.

To put it another way, independent renewables developed during 2018 added 329MW of capacity to the overall 14.1GW total. Scotland accounted for 276MW of that additional capacity, thanks to five major onshore wind farms being connected to the grid. Overall however, Solar remains the most dominant technology in the sector, contributing 6GW of the total independent renewable capacity.

End users continued to see the benefits of deploying on-site generation too. 23 new on-site projects went live in 2018, meaning that the total capacity of this group of projects rose to 740.8MW across 928 sites.

Due to further cuts in revenues, through Embedded Benefits being altered under the Targeted Charging Review, market conditions for new renewables are expected to remain challenging. Yet the journey towards a subsidy-free landscape has not deterred the innovation and ingenuity of energy entrepreneurs, who are now diversifying their revenue streams to help support the investment case for independent generation.

Flexibility is the key for project developers who want to access the new wave of services required, so that National Grid can continue to balance the network. As baseload power from large coal stations diminishes and planned nuclear projects fall by the wayside, greater opportunities exist for independent renewables to take part in the expanding marketplaces for capacity, frequency and balancing services.

The chance for embedded generators to enter the Balancing Mechanism (BM) as part of an aggregated unit represents another significant new opportunity. By offering this service, assets can combine their generating capacity with that from other projects to offer services to National Grid. Changes like this are already happening, as shown by SmartestEnergy’s Generator Revenue Stack Survey, which revealed that 41% of energy entrepreneurs are already responding to changes in the commercial landscape and are now considering providing ancillary services alongside traditional offerings.

New technologies are also in play now too, with project developers shifting their focus towards investing in battery storage and gas peaking plant. In 2018 alone, battery storage in the UK’s planning pipeline doubled, reaching 4.9GW by the year-end. Gas peakers which delivered in 2018 also received £36.6m in investment from existing energy entrepreneurs, displaying a noticeable trend towards using these technologies to complement renewable projects.

Look out for the next blog in this mini-series too, which will cover battery storage deployment and how the market is developing as technology costs come down.

About the author

Dave joined SmartestEnergy in 2017 and is responsible for all commercial activity across retail supply, generation, trading and asset optimisation. He has held director level roles with both “Big 6” and large energy consultants and he played a leading role in the development of flexible contracts in the industry. Dave joined SmartestEnergy from Inenco Group where he was Chief Commercial Officer with board responsibility for client relationships. Previous roles have included both I&C and latterly Domestic Market Director for npower, managing a team of over 1,400. He has also worked for Utilyx and Northern Electric and Gas. He is a Member of the Institute of Directors.

United States

United States Australia

Australia