Posted on: 16/04/2024

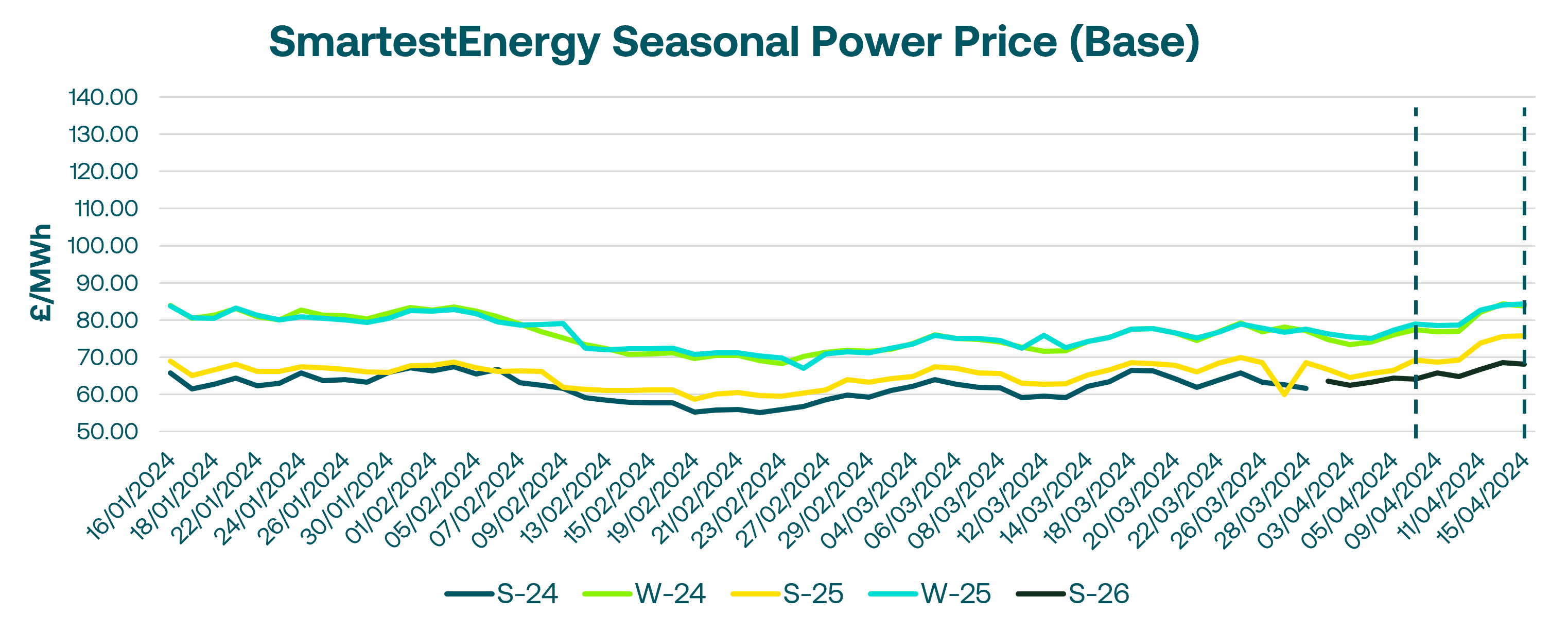

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 9th April –15th April 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £68.56/MWh for the Summer-26 seasonal power price on 12th April. In this blog, Fanos shares the market news and updates from the last week.

The gas and power markets opened the week on a softer note on Tuesday, trading sideways amid robust supply and strong renewable generation. Norwegian flows were up and LNG deliveries stable, leaving storage inventories comfortable. Front-month, quarter and seasonal UK power contracts were the most actively traded, with warmer weather and higher wind output over the weekend pressuring prompt base prices down towards £15.50/MWh.

Wednesday saw a continuation of the sideways trading, with fundamentals remaining bearish due to the mild temperatures and ample supply. However, emissions prices provided some support, nudging prices slightly higher. UK power followed suit, with limited liquidity beyond May 2024 contracts. The May 2024 baseload contract witnessed 225MW of trading activity.

The market sentiment shifted dramatically on Thursday with news of attacks on Ukrainian gas storage facilities. This, compounded by reports of reduced gas flows to the Freeport LNG facility due to operational issues, sparked a rally in both NBP and TTF prices. Heightened supply concerns were the driving force behind the increase. UK power mirrored the rise in gas and carbon, with over 200MW of Winter 2024 baseload contracts changing hands. However, the prompt market remained under pressure due to the warmer outlook and strong renewables, with day-ahead and weekend baseload clearing below £25.40/MWh and £10/MWh respectively.

Friday witnessed a continuation of the bullish momentum despite early indications of a well-supplied system and easing demand from warmer weather. Buyers emerged to support prices, potentially reacting to the broader geopolitical tensions in the Middle East, fueled by the highly publicized US intelligence reports on the escalating conflict. Front-quarter and seasonal gas contracts remained responsive to these concerns.

The week ended on a surprising note, though. Despite the deepening crisis in the Middle East, energy markets reacted bearishly on Monday. The weekend developments in the Middle East seemingly did not translate into significant supply disruptions, leading to a price reversal.

United States

United States Australia

Australia