Posted on: 19/03/2024

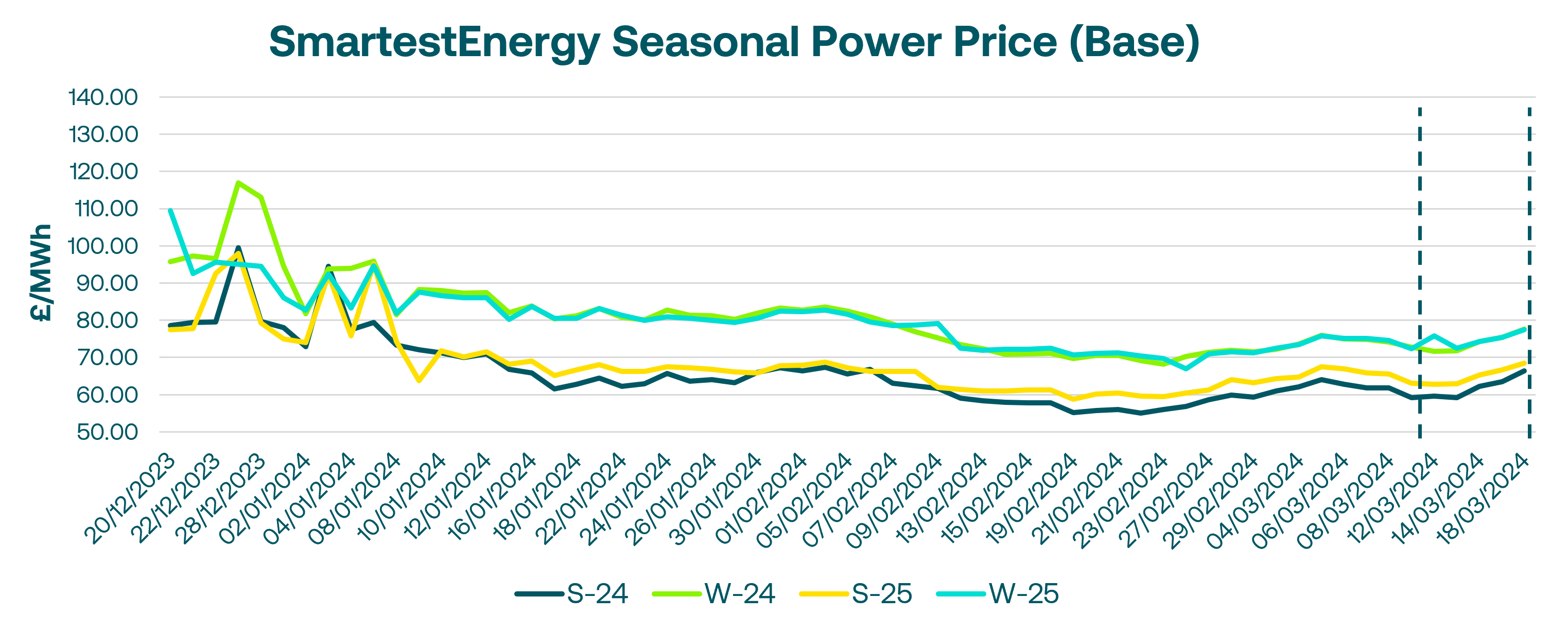

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 12th March – 18th March 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £66.42/MWh for the Summer-24 seasonal power price on 18th March. In this blog, Fanos shares the market news and updates from the last week.

Tuesday saw a less volatile trading session for gas. After an initial softer open, prices recovered small losses to close nearly flat. The UK gas system was 11mcm oversupplied in the morning. Gas burn for power demand was lower amid stronger renewable output, with wind forecast to peak at 16GW Wednesday and hold above 10GW until Friday evening. Warmer weather forecasts added further downward pressure.

With only two weeks remaining in the current Winter contract period, Europe looks set to end winter with record gas storage inventory levels. Successive mild temperature winters and high wind output enabled European nations to manage well despite the lack of Russian gas exports. Recent losses in Summer 2024 power saw buyers covering positions on Wednesday, providing modest price support. Additional buying interest likely stemmed from peakload positions covering in lieu of limited Summer peakload liquidity.

European gas rallied on Thursday though fundamentals remained bearish, potentially due to profit-taking and some stop-loss buying. UK power followed suit, with gains amplified by a recovering carbon market.

Fundamentals on Friday indicated a well-supplied market with minimal day-on-day change to the risk outlook. The UK system opened 7mcm oversupplied but thin liquidity with some major market makers absent saw little volume establish new price benchmarks as positions closed out ahead of the weekend.

An up day for markets on Monday as reduced Norwegian flows from outages provided upside. Wind output set to decline below 2GW early Wednesday, increasing expected gas burn for power generation. Concerns also lingered over LNG supply competition from Asia. April 2024, Q2 2024, and Winter 2024 contracts were most actively traded on the UK power curve.

United States

United States Australia

Australia