Posted on: 23/04/2024

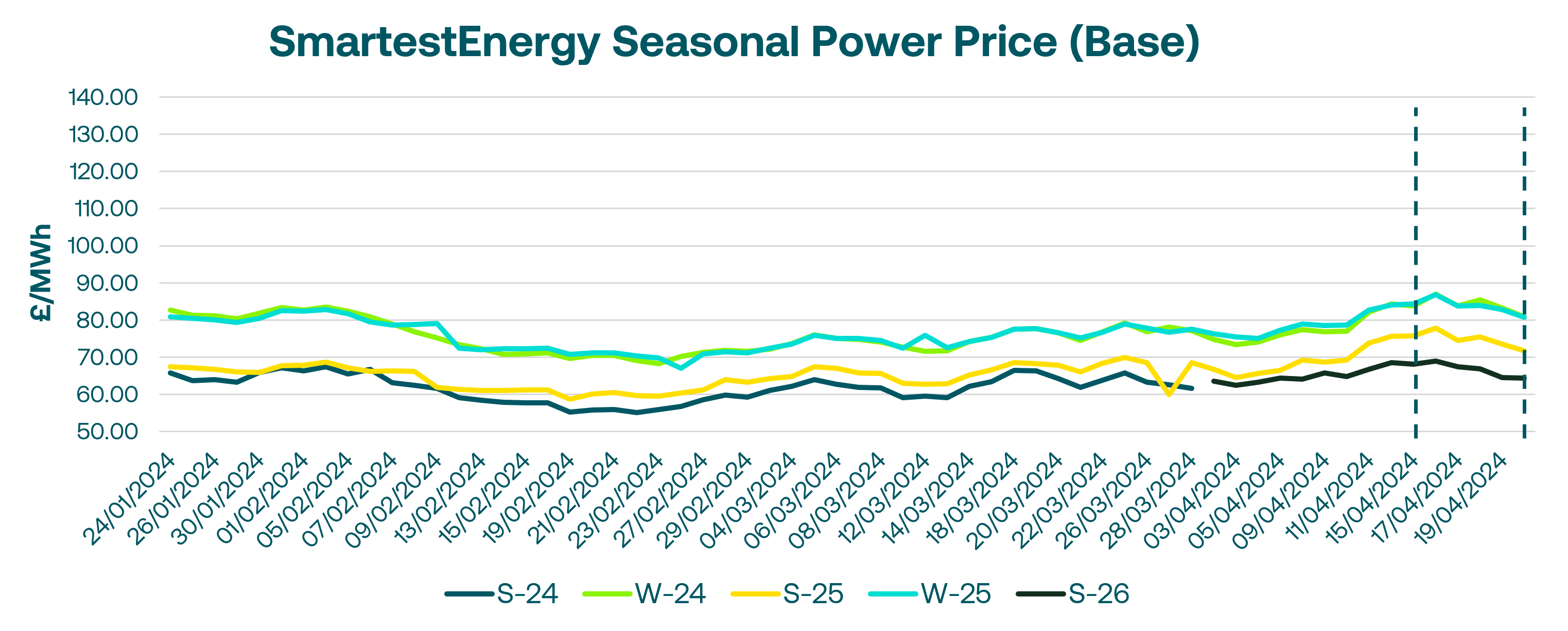

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 16th April –22nd April 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £69.00/MWh for the Summer-26 seasonal power price on 16th April. In this blog, Fanos shares the market news and updates from the last week.

Tuesday saw another rally in European gas prices, reaching a 3-month high at the TTF hub. This was driven by Norwegian outages, concerns over further disruptions at the Freeport LNG facility, forecasts for colder weather, and heightened geopolitical instability. UK power prices also recovered strongly, boosted by the higher gas and firmer carbon markets, with the front-month UK baseload contract trading nearly 350MW.

However, the bullish momentum fizzled out on Wednesday as the European gas market fully retraced Tuesday's gains. Ample storage levels and expectations for temperatures to normalize to seasonal levels next week appeared to cap the upside. UK power prices also corrected lower, suffering additional pressure from a weaker carbon market, though day-ahead baseload on N2EX cleared £4/MWh higher amid forecasts for lower wind generation.

Thursday was characterized by a lack of liquidity and scarcity of offers for UK power and gas seasonal contracts. The UK gas system opened 30mcm oversupplied, with demand expected to drop significantly on increased temperature forecasts. National Grid also formally launched the UK-Denmark "Viking Link" power interconnector.

On Friday, forward prices pared back gains from the previous session. Prompt markets remained well-supplied, with the UK gas system opening 21mcm oversupplied in the morning.

European gas eased on Monday as temperatures were expected to rise again next week and there was no escalation in Middle East tensions. Fundamentals remained bearish with gas storage currently 62% full. UK power also took a breather, losing at least £2/MWh across the curve, though downside was limited by a firm carbon market.

United States

United States Australia

Australia