Posted on: 05/03/2024

In this blog, Leigh Brown, Senior Business Development Manager at SmartestEnergy, delves into the evolving landscape of Contracts for Difference (CfDs) as registrations open for the latest allocation round. He discusses the industry concerns and the importance of a reformed approach that prioritises the long-term benefits of growing the UK’s renewable energy landscape.

The Contracts for Difference (CfD) scheme plays a vital role in supporting the UK's transition to a low-carbon future by providing long-term price stability for renewable energy generators. As CfD Allocation Round 6 (AR6) approaches, navigating the evolving landscape and understanding potential opportunities is crucial for stakeholders across the energy sector.

Looking back at CfD AR5

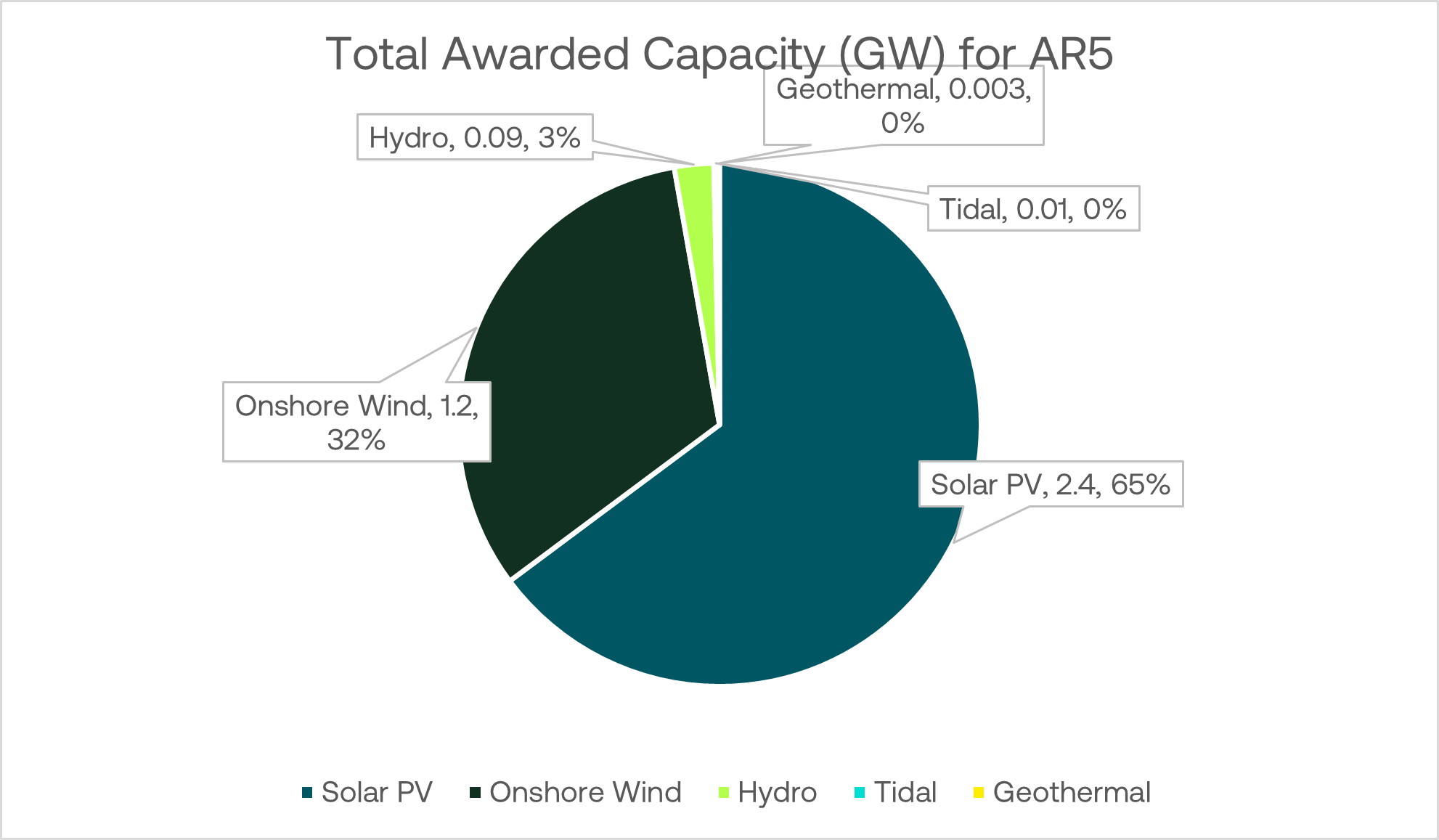

While the official budget for AR6 is yet to be announced, the previous round (AR5) saw a total allocation of £205 million [Pot 1 (established technologies): £170 million & Pot 2 (emerging technologies): £35 million (including a minimum £10 million ringfenced for tidal stream projects)], distributed across established and emerging technologies.

In contrast to established renewables like solar, onshore wind, hydro, and tidal which received CfDs in CfD Allocation Round 5 (AR5), offshore wind developers remained absent. This highlights the need for a more targeted approach, which AR6 addresses by introducing a dedicated pot specifically for offshore wind (Pot 3). Although the total awarded capacity (3.7 GW) fell short of the 11 GW awarded in AR4, it underscores the continued commitment to diversifying the UK's renewable energy mix.

Unlocking Diverse Revenue Streams: Beyond CfDs

CfDs provide valuable support, however, maximising revenue potential requires exploring a broader spectrum of opportunities. This includes:

- Ancillary services:Providing essential grid stability services can generate additional income for generators

- Flexibility markets:Participating in markets where generators can adjust their output based on grid demands offers new revenue streams

- Other emerging opportunities:Staying informed about and exploring evolving market dynamics is crucial to unlock additional revenue streams.

AR6 Pots: Supporting Established and Emerging Technologies

Building on the success of previous rounds, CfD AR6 introduces confirmed technology groups, also known as "pots," offering clarity and predictability for developers.

The three pots are:

- Pot 1: This pot caters to established players like onshore wind and solar.

- Pot 2: This category focuses on promising new technologies with high growth potential, such as floating wind and tidal.

- Pot 3:This one's dedicated to the powerhouse of offshore wind.

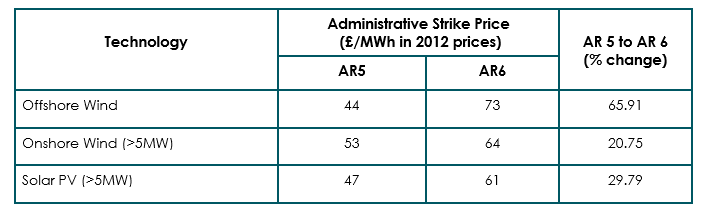

Administrative Strike Prices (ASP)

Additionally, each technology within the pots has an ASP, which acts as a cap on the level of CfD support it can receive. Below is a table comparing the ASP from AR5 and AR6.

For further information and clarification, please refer to the official CfD microsite.

CfD Budget: Addressing Concerns and Ensuring Sustainable Growth

The CfD budget faces scrutiny, with industry leaders like Tom Glover (RWE) expressing concerns about its ability to sustain long-term renewable energy growth. Critics argue budget calculation methods overestimate costs and underestimate future prices, leading to faster budget depletion. However, others like RenewableUK acknowledge the scheme's positive impact in stimulating renewable development, emphasising the need for a balanced approach to reform that considers both budgetary constraints and long-term sustainability.

Ready to unlock the revenue potential of CfDs and navigate the ever-changing AR6 landscape?

Join us for our upcoming webinar on March 12th 2024, where we'll delve deeper into the CfD scheme, explore potential opportunities and challenges in AR6, and discuss insights on maximising revenue potential for your generation assets. Don't miss out on this valuable opportunity to gain a competitive edge! Register today and secure your spot!

Join the Discussion: Unpacking CfD Price Forecasts and Market Movements

Gain valuable insights from our expert panel:

- Guest Speaker: Lucy Dolton, Lead Analyst at Cornwall Insight

- Leigh Brown, Senior Business Development Manager

- Alex Walmsley, Head of Pricing

- Wai-Hong Man, Pricing Analyst

Together, they will discuss:

- Price forecasts for subsidy schemes and embedded benefits

- An in-depth view of wholesale market movements

Register for the webinar here > https://www2.smartestenergy.com/l/53352/2024-02-22/ljy56y

Please note: Only business email addresses are valid for registration. If you are unable to provide a business email address, please contact [email protected]

United States

United States Australia

Australia