Posted on: 05/03/2024

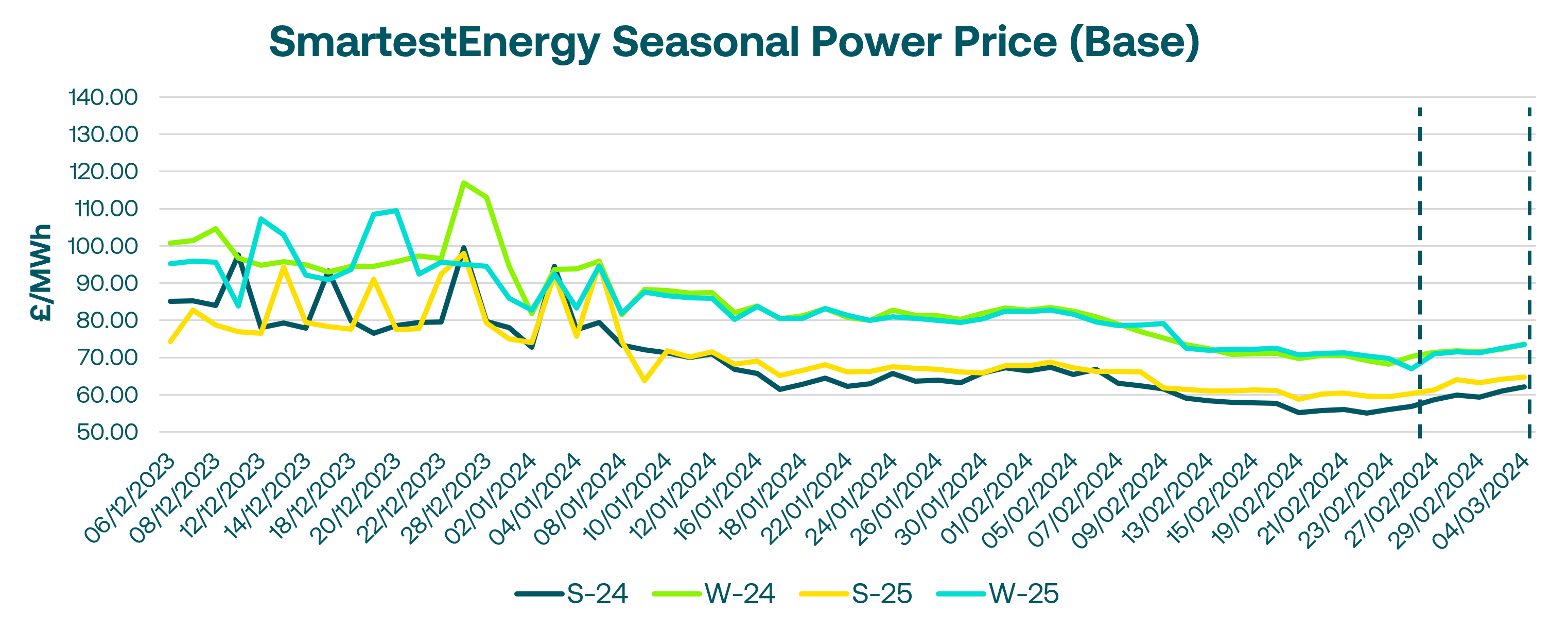

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 27th February – 4th March 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £62.12/MWh for the Summer-24 seasonal power price on 4th March. In this blog, Fanos shares the market news and updates from the last week.

Last week's bearish sentiment took a pause as the UK gas system opened undersupplied on Monday, with demand holding firm and supplies down day-on-day. Despite forecasts for warmer temperatures from Tuesday, buying interest outweighed sellers, particularly for Summer 2024 power contracts as well as Q2 and Q3 2024 which saw the most trading activity. Stronger continental demand outlook lifted TTF prices, effectively leading the UK commodities trend. While Summer 2024 baseload barely traded all day, the benchmark gapped up nearly £3 by the session's end.

The gas rally extended for a third straight day Wednesday, with prices hitting a 2-week high on rising coal prices, adverse short-term weather, and short-covering. Power also traded higher, supported by a bullish carbon market. The front-month baseload power contract expiring Friday traded a total 450MW volume.

On Thursday, March 2024 UK power rose as it went into delivery, while the rest of the curve declined. High inventory levels and stable supply provided the upside, aided by the extended Freeport outage.

Friday opened undersupplied again for the UK gas system by 19mcm, with storage withdrawals up 20mcm to offset reduced LNG sendout and UKCS receipts. The shortfall was mainly supply-driven though demand underperformed expectations, still not enough to offset the supply losses.

European gas prices climbed higher again on March 4th as forecasts called for a cold spell and low wind generation over the next week. A fire aboard a vessel off Yemen also contributed to the bullish sentiment. UK power traded up as well, boosted by a recovering carbon market, though liquidity remained low despite the intraday volatility. The Winter 2024 baseload was the most traded power contract with 135MW total volume.

United States

United States Australia

Australia