Posted on: 05/09/2023

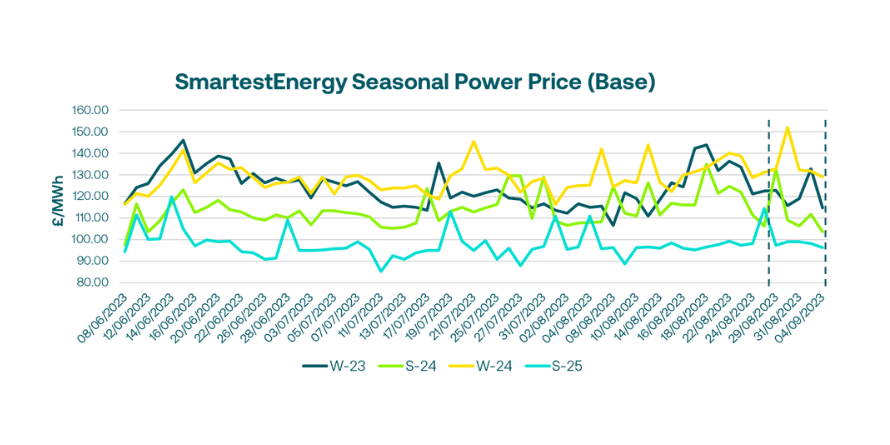

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 29th August – 4th September 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £132.92/MWh for the Winter-23 seasonal power price on 1st September. In this blog, Fanos shares the market news and updates from the last week.

At the beginning of the week European gas prices started to ease, despite the continued risk of Australian LNG workers industrial action plans. Total Norwegian export nominations dropped to 46mcm/d lower due to 1-day maintenance at the Emden exit terminal, and continental wind expectations for the rest of the week fell below the historical average outturn. Liquidity on UK power was quite low, with front month baseload trading the most as it neared expiry.

Later in the week, the gas system opened short due to lower LNG send-out and high storage injections of 25mcm/d. European gas prices fell again on weak demand and high storage, with the market participants waiting for news on the Australian LNG strikes. UK power prices reduced across the board on weak gas and carbon.

On Friday, European markets opened to the news that the Australian LNG Workers union, the “Offshore Alliance”, had rejected the latest offer from Chevron and will now enter into mediation via the Fair Work Commission. This increased the probability of industrial action of up to 11 hours of strikes per day commencing 7th September until at least the 14th. It is estimated that such action would equate to a loss of 1.5 cargoes per week, which would equal around a 20% reduction in capacity.

The market response remained bearish on the curve, whilst support for the month-ahead contract remained. Meanwhile, very little changed in terms of imports to the UK, with flows nominated flat day on day and mildly cooler temperatures increasing consumption slightly.

This Monday, gas prices eased as strong bearish fundamentals outweighed the threat of Australian LNG strikes; Chevron Australia has started talks to prevent the strike from going ahead on Thursday. The interest for seasonal UK power was minimal, with less than 35MW traded before 4 pm, and only a small portion of Summer-24 and Winter-24 traded in the last trading hour. Q1-24 was the most popular, followed by October-23 and Q4-23 contracts.

United States

United States Australia

Australia