Posted on: 16/05/2023

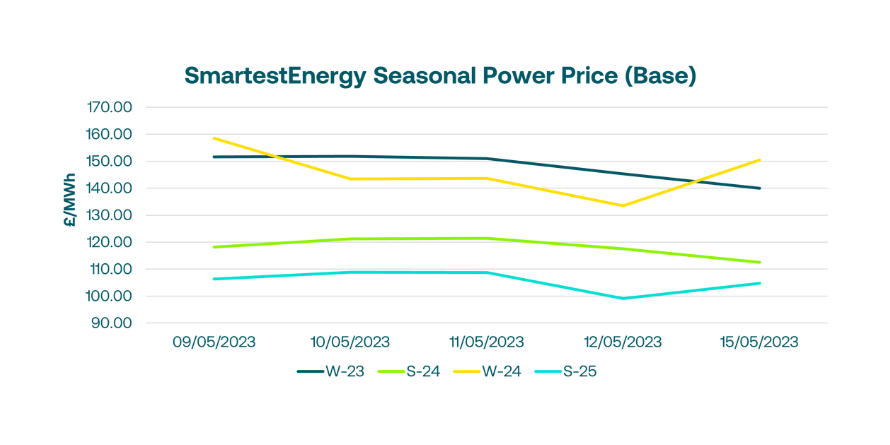

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 9th May – 16th May 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £151.75/MWh for the Winter-23 seasonal power price on 10th May. In this blog, Fanos shares the market news and updates from the last week.

Last week higher demand for gas was expected amid low wind output. However, warmer weather promptly reversed the demand increase. UK gas system was short with reduced domestic supply due to maintenance, as well as reduced LNG sendouts. There hadn’t been any gas imports via Baltic Pipe for five days due to maintenance at Nybro.

Near term prices softened with strong gas inventories offsetting short term maintenance at Norwegian and Danish facilities. European gas continued to look weak, with front-month TTF falling near to a 2-year low amid robust supply and high storage levels. Continental Northwest European gas storage were at 336TWh, 62% full compared to 34% full same time last year.

Mid-week, high inventory levels in Europe added downward pressure on gas and power prices. Furthermore, ample LNG supply from Asia added volume, where inventory is high as well.

European gas prices sharply dropped yesterday morning at almost a 2-year low on the back of strong supply and comfortable European storage level at now 63.7% full. UK power followed the bearish gas and carbon markets, while day ahead prices remain below three-digits.

United States

United States Australia

Australia