Posted on: 27/06/2023

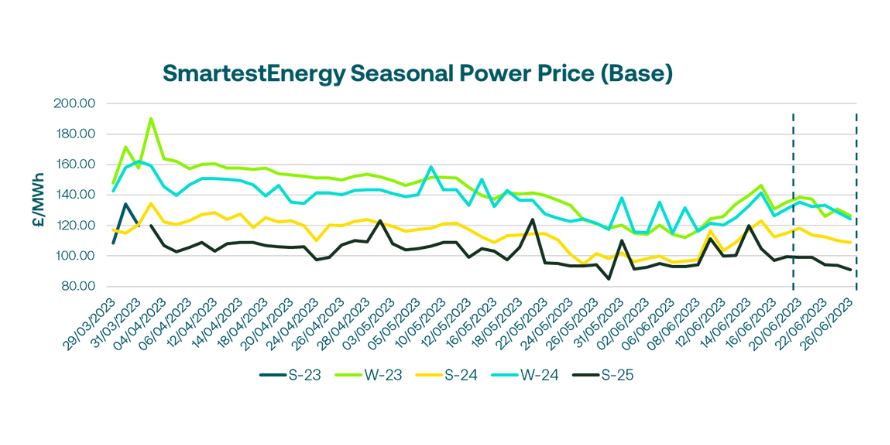

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 20th – 26th June 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £138.75/MWh for the Winter-23 seasonal power price on 20th June. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday, we saw gains continue with the opening bids for near term contracts for power supported by lower renewables generation expectations in the UK. Reduced pipeline flows into UK from Norway supported gas prices. Stronger exports to continental Europe made for a tighter system margin in the UK. Seasons out to Summer 2026 traded with 5MW confirmed at £86.50/MWh.

On Wednesday, the UK gas system was short in the morning. Both gas and power traded sideways, reaching within day high around midday and we saw bullish sentiments amid concerns with Norwegian supply.

European gas storage was 74.94% full on Thursday and the UK is expecting two LNG vessels to arrive in the next couple weeks. N2EX Day Ahead auction baseload cleared £13/MWh lower day on day as wind generation picked up early morning.

By Friday, the demand outlook eased off and with increased Norwegian supplies, forward price trend was led by the latest prompt fundamental drivers (increased supply and reduced demand). Norwegian exports to UK and Europe increased by 7mcm day on day whilst the latest 2-week temperature outlook indicates lower consumption expectations. European storage inventories remain 30% higher than the five-year average at 79 bcm, indicating a potential 95% full level by mid-September if the June-23 injection rate continues.

NBP Front month, quarter and season opened more than 10% up as traders were closing part of their short positions yesterday morning amid the political situation in Russia. Prices decreased to Friday’s level in the afternoon crossing into negative.

United States

United States Australia

Australia