Posted on: 15/08/2023

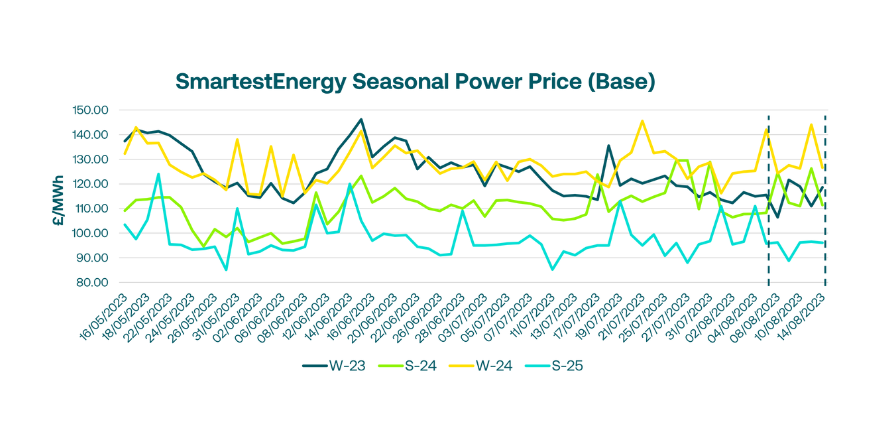

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 8th – 14th August 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £121.66/MWh for the Winter-23 seasonal power price on 9th August. In this blog, Fanos shares the market news and updates from the last week.

At the start of the week, the markets opened bearish, as analysts cited record high gas inventories across Europe, with stocks equating to 31% above the 10-year average for historical August records. These high storage levels in August follow record-high stocks from last winter offsetting the slow ramp-up of gas injections in April.

Whilst forward prices have reduced over the last week, we saw a slight increase Tuesday afternoon only to be sold back down at the close to register a loss for Power across the forward periods and a reduction in Winter-23 NBP price.

Into the week, gas prices reached a 30 day high amid potential LNG outages in Australia due to strike action. Currently, no timeline has been given for the strike, but if it does go ahead, Europe may face competition with Asia for LNG deliveries. As a result, trading on front month and quarter contracts was affected, with September-23 NBP trading as high as 110.47 ppth and TTF at €43.545/MWh. On the UK power curve, the September-23 contract was also bullish, with almost 400MW trading.

At the end of the week, we saw a very pronounced retraction in the forward contracts from the markets' initial reaction to the Australian LNG strike news. Whilst NBP for September and Winter-23 contracts pared back 6% and 1% respectively, power purchasers could not take advantage of the fall in price beyond September due to poor liquidity in the seasonal contracts.

Yesterday, short-term gas supplies remained strong across UK and Europe. Total exports from Norway are up by 5mcm against Friday's exports, whilst markets seemed unaffected by the Norwegian Vesterled pipeline outage extended to 22nd August. This week, temperatures are expected to drop, followed by a heatwave into next week, keeping demand flat to softer than previous expectations.

United States

United States Australia

Australia