Posted on: 28/02/2023

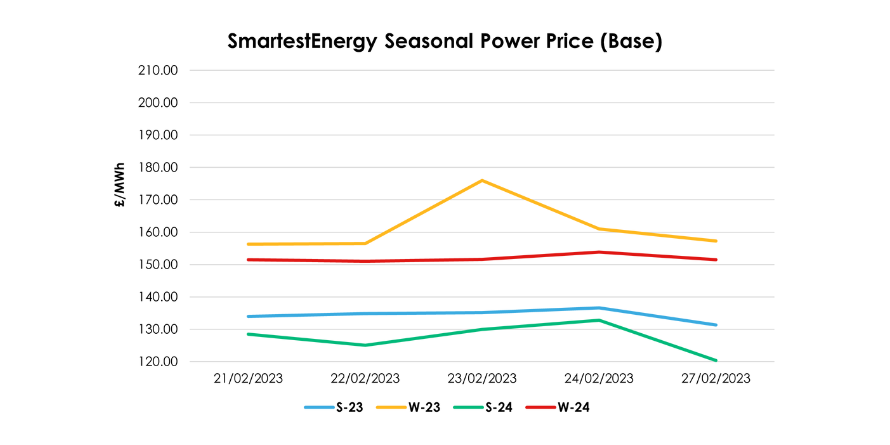

Head of Sales Trading, Fanos Shiamishis, reports on the energy market activity, covering the period 21st – 28th February 2023. On our end-of-day pricing tool, the Source, we published an in-week high of £136.57/MWh for the Summer-23 seasonal power price on 24th February, reducing to £131.32/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Early last week, we saw minimal changes to the supply and demand outlook for the near term, as temperature and wind forecasts remained relatively unchanged day on day. The UK gas system opened strong, with an overall healthy and stable supply, amid stronger Norwegian flows via the Langeled pipeline.

The UK T-4 Capacity Market auction for the 2026/27 delivery year cleared at a record £63/kW and 43GW of de-rated capacity has been secured for the UK. A key driver of the high clearing price is there was less competition in this year’s auction, with a number of participants opting out due to operational reasons. A provisional list of the UK assets that have successfully secured a contract can be viewed here.

Later in the week, we saw a relatively quiet day in the UK power market with less than 250MW of seasonal volume going through. With March nearing expiry, the final settling of positions in the UK gas market supported the March-23 contract, with enough gains made during the day to hold off a late sell-off in the final hour of the day.

This week, we may see demand for gas to increase amid an unplanned French nuclear outage at Paluel 4, adding to the current schedule of statutory outages losing around 1.3GW of generating capacity. However, yesterday, a warmer 35-day temperature outlook and a strong LNG supply schedule saw prices reduce, with a bearish trend continuing throughout the day.

United States

United States Australia

Australia