Posted on: 24/01/2023

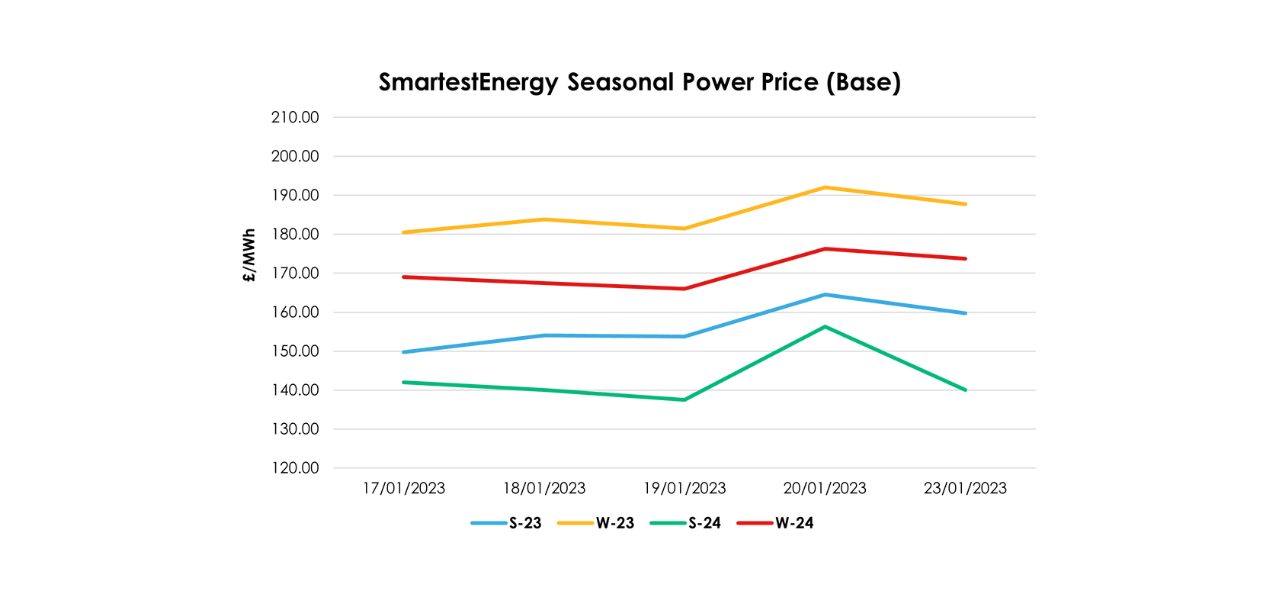

Head of Sales Trading, Fanos Shiamishis, reports on the energy market activity, covering the period 17th – 24th January 2023. On our end-of-day pricing tool, the Source, we published an in-week high of £164.50/MWh for the Summer-23 seasonal power price on 20th January, reducing to £159.74/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Last week we saw Norwegian and continental European gas flows reduce, as well as a decrease in gas demand for power generation. However, increased forecasts and storage withdrawals on 17th January added support, which indicated price recovery throughout the week.

Norwegian flow and LNG deliveries remained slightly lower throughout the week despite further drops in Russian pipeline flows, with nominations at the Velke Kapusany pipeline, from Ukraine to Slovakia, down 30 % day-on-day. Meanwhile, gas for power demand increased as French nuclear availability reduced, dropping 0.9 GW due to nationwide strikes. In the UK, Local Distribution Zone (LDZ) demand remained strong due to the cold spell and had a healthy LNG gas send-out.

On Friday 20th January, we saw a 10% increase in power prices across Europe as EDF's Nuclear Reactor, Gravelines 3, incurred a forced outage. EDF said maintenance teams are carrying out checks to enable production to restart as soon as possible, with the expected restart date marked for 25th January.

Over the weekend, we saw three coal-fired power stations warmed in readiness for any shortfall in power generation to help meet demand. This was subsequently cancelled and not required, but we did see the UK power system on mainstream news with the National grid exercising the Demand Flexibility Service to incentivise a domestic reduction in power as UK demand is high.

United States

United States Australia

Australia