Posted on: 31/10/2023

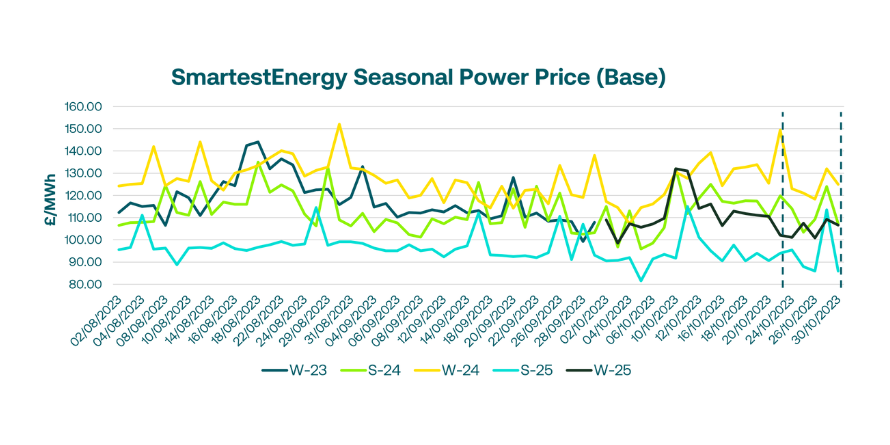

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 24th – 31st October 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £124/MWh for the Summer-24 seasonal power price on 27th October. In this blog, Fanos shares the market news and updates from the last week.

Early last week, UK power and gas in the near term opened relatively well supplied, offseting the increase in demand due to cooler temperatures into November. On Tuesday, the latter half of the day’s trading session resulted in a significant sell-off across power and gas, both NBP and TTF. Whilst not substantiated by any direct fundamental news, the trend was preceded by a series of headlines from the Finnish investigative authorities looking into the recent pipeline damage in the Baltic Sea. The headlines surmised that the damage was a result of an accident, thereby abating any risk of escalation of regional conflict.

On Wednesday, the UK gas system was short in the morning, whilst Norwegian flow to the UK was up. NBP struggled to find a direction, reaching the high of the day around 2pm, to later decline and bounce back. Geopolitical tensions were the main bullish driver while supply was strong. On the UK power curve, interest was focused on near-term contracts, but simultaneously, we saw small volumes trading as far as Winter-26.

Later in the week, decreased LNG send out and IUK exports, unplanned Norwegian outages, and rising heating demand caused European prices to rise. Meanwhile, UK power was bearish across the board, with clean sparks much lower on strong selling pressure.

On Monday, continued unplanned Norwegian outages and the news of the stoppage of LNG deliveries from Egypt prompted a strong morning rally. However, the impact of no LNG deliveries to Europe from Egypt appears insignificant. There was minimal interest on the UK power curve, with more sellers than buyers present, and the most traded contract was November-23, as it approaches delivery shortly.

United States

United States Australia

Australia