Posted on: 11/01/2022

January 2022

Head of Sales Trading, Fanos Shiamishis and Spot Power Trading Analyst, William Lake comment on December’s wholesale market activity. They recap on another month of continued high prices across the forward and spot markets.

Seasonal gas and power prices

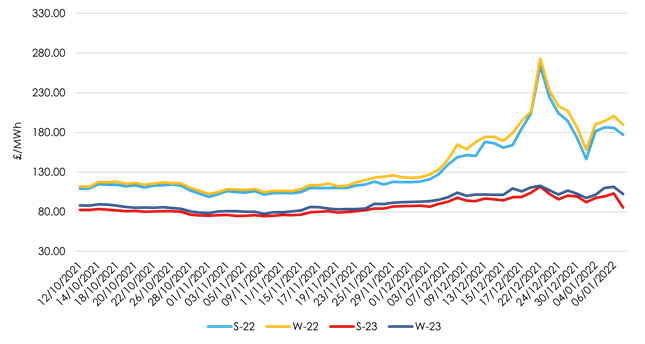

We continued to see extreme price volatility over the last month as the Summer-22 seasonal power price increased from £117.25 on 1st December to an in-month record-high of £264/MWh on 22nd December. However, gas prices did reduce, and Summer-22 closed at £146.40 on the 31st December.

Liquidity in the power market remains thin with heightened intraday volatility at times, whilst any spark spread positions looked to track the gas price changes with any volume quoted for the Q1-22 contracts in the run-up to expiry. Occasionally, power was very scarcely available meaning any trading activity would tend to sharply move prices up or down by a higher rate than the gas price changes for the same contracts.

Summer-22 gas led the upward trend, opening the month at 111.26ppth, reaching 325.25ppth on 22nd December and closing at 156.73ppth on 31st December. Price rises generally tracked the renominations and actual flows through Ukraine into Europe, coupled with the military build-up at the Russian and Ukraine border, as well as weather data, traders remained very cautious about changes in the nominations.

A very mild Christmas and Russian announcements that the second string of the Nordstream 2 pipeline had been completed saw some abatement of the rally into New Year’s eve, but that has subsequently reversed with Summer-22 Gas now trading at 210p/therm (as of 6th January 2022).

Summary of oil, coal and carbon markets

In oil markets, Brent Crude has remained rangebound this month. The first half of December saw the contract testing the lower $70; the front-month opened at $69.03/barrel, trading between $70 to $74/barrel from the 5th to 17th December. Traders remained poised around global Governments COVID data and expected some announcements of preventative lockdown measures in the run up to the holidays. Bearish expectations coupled with strong inventory updates throughout the month and lower than expected drawdowns saw the price drop to $60.68. However, most COVID related news and measures focused on vaccine rollouts added some bullish demand sentiment at the end of the month with the benchmark Brent contract closing the month at $78.40.

Coal (ARA spot) continued to be led by Asian demand and further risk to supplies was factored in when Indonesia declared an “Energy Emergency” on 1st January, banning any exports of domestic coal. The emergency was subsequently called off on 7th January. Coal spot price began the month around the $123/tonne mark, increasing to $147.90 on 16th December and closing the month at over $137.55/tonne.

Carbon EUAs saw a flurry of trading early in the month in the run up to Dec-21 contract expiry, with proprietary traders liquidating positions or rolling into Dec-22. As gas and power softened and Dec-21 expired we saw the price drop to €74/tonne on 17th December, recovering back to over €80 by 20th December. In mid-December UK ETS announced no new UK allowances to be released under the CCM (Cost Containment Mechanism) with the next review being announced by 18th January. The intervention by the CCM review was triggered after the average price in October, November and December exceeded the January trigger price of £56.58/Tonne.

Short-term energy markets

The maximum system price was £2140/MWh on the 3rd December between 1430 and 1500. This peak value was reached as the system started going short and Balancing Mechanism (BM) offers, instead of bids, started to set the price. Five different CCGT units were brought on to take advantage of this high price, all in excess of £2000, with Rye House being the top accepted offer at £2150/MWh. Demand peaked at around 43GW when the wind outturn was only around 4GW. The period from September to November saw balancing costs rise by 234% compared to the same period in 2020, with nearly £1billion spent. The National Grid ESO announced it will be reviewing how power generators are paid after 2021 became the most expensive balancing year on record. There were no major losses of thermal or nuclear generation during the day.

The minimum system price reached -£68/MWh on 5th December between 05:00 and 05:30. The 5th December was a Sunday and demand was incredibly low so the system was long by over 500MW. The entire weekend of the 4th/5th December was incredibly windy which caused the system price to come close to negative on several occasions. On the morning of the 5th December, there was nearly 2.5GW of wind curtailed by the National Grid due to system flow constraints.

Maximum Day Ahead N2EX prices (Base) reached a peak of £411.60MWh on 16th December. This summed up another month of high prices; there were three days in quick succession which saw prices of over £400 and the average baseload price for December was £245, well clear of the previous £189 record set in September. Wind levels from mid-December until Christmas Day were less than a third of seasonal norms, which combined with new record high gas prices created very tricky conditions. Wholesale gas prices topped 450p per therm before crashing on the news that LNG tankers were being diverted from Asian destinations to Europe. For much of the year, Asian buyers have outbid Europeans for LNG cargoes, but now, as their storage is mostly full, some ships are turning mid-voyage to Europe for very attractive gas prices. An extra 5 million cubic meters made its way to Europe causing the TTF and NBP to drop significantly. The NBP closed for the year at around £160, levels not seen since September. This temporary fix in gas supply did little to calm nerves about future energy scenarios and when trading resumed in January, the TTF shot up by over 30% as operators were concerned over supply levels.

Register for our next Market Update Webinar

Tune into our next monthly webinar on the 7th February at 3pm for the latest insight from our traders on the power market activity for January and the headline energy news stories spanning: security of supply; regulation; policy and innovation.

United States

United States Australia

Australia