Smartest Insight | Issue 104

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

January 26, 2023

Market Update:

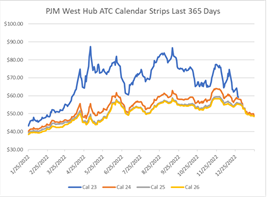

The gas market has had a ping pong type week with several days of +/- $0.25/MMBtu moves but ultimately is lower on bearish fundamentals and weakening short-term weather. The 6-15 day portion of the forecast is currently below to much below normal depending on location but not as cold as initially feared late last week. Power is trading at its lowest price dating back to the Freeport explosion which is ironic given that Freeport submitted an official restart request to FERC on Tuesday.

1 year view of the calendar strip price

Freeport Makes Filing With FERC:

On January 23, 2023, Freeport LNG made a filing with the Federal Energy Regulatory Commission (“FERC”) stating that it had completed repairs to its LNG export facility and asked FERC’s permission to send LNG into the facilities piping system. The procedure is expected to take about 11 days and is the first step to returning the export facility to normal operations. Freeport asked for a response to its request by January 24. If FERC acts quickly, it could mean a return to service in February. Freeport has not operated since June 8, 2022, when a fire caused it to incur significant damage. The U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration (“PHMSA”) also needs to provide approval before Freeport can restart. Freeport’s return to service will increase U.S. LNG exports by 2 BCf/d, which will have a material effect on U.S. natural gas prices.

Texas PUC Recommends Major Market Change:

On January 19, 2023, the Texas PUC voted to recommend a Performance Credit Mechanism (“PCM”), which will require retail electric suppliers to procure performance credits. The PUC will recommend the PCM to the Texas legislature but will not immediately implement it. The PCM looks very much like the capacity markets implemented by northeast ISOs, as it will be a centrally cleared market administered by ERCOT using a demand curve under which generators will earn performance credits for their availability during peak hours. The PCM is a part of a Texas PUC reliability study commissioned last year which presented and analyzed several market design proposals intended to improve grid reliability and mitigate cost volatility. Implementation will require resolution of market design issues and approval by the legislature.

Ørsted Takes Write Off for U.S. Wind Project:

On January 19, 2022, Ørsted Wind announced a write down of $366 million on its 924MW Sunrise Wind project. Ørsted cited significantly higher interest and project costs since it signed its 25-year Power Purchase Agreement (“PPA”) with the New York State Energy Research and Development Authority (NYSERDA”) in 2019. Sunrise Wind is expected on-line in 2025. There are more then 17,000MW of contracted offshore wind projects being developed in the northeast, all of which face these cost pressures. There is certainly a risk that the owners of these projects will abandon the projects absent amendments to their PPAs.

Avangrid Asks Court to Terminate Offshore Wind PPAs:

On January 19, 2023, Commonwealth Wind, an Avangrid subsidiary, filed a motion with the Massachusetts Supreme Judicial Court to overturn the Massachusetts Department of Public Utilities (“DPU”) approval of the offshore wind Power Purchase Agreements (“PPAs”) That it signed with three of the state’s utilities. In December 2022, Commonwealth had asked the DPU’s permission to renegotiate the PPAs, but the DPU rejected that request. This latest action puts the 1230 MW project in jeopardy.