Smartest Insight | Issue 147

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

December 13, 2023

Market Update:

NG storage draw for w/e 12/1/23 was -117 BCF on an expectation of -105 BCF rendering the market flat. However, new weather reports on Sunday beared down prompt by $0.25/MMBtu this week. We are currently sitting near at $2.30. The current 8-14 temperature expectation is calling for above norm temps across the country. Dec is on track to be the 3rd warmest on record. The top 10 warmest Decembers have occurred after 2000 showing that warm winters are becoming the new norm.

Also contributing to prices is the decrease in future demand due to ExxonMobil's news that Golden Pass LNG terminal construction will be delayed to 2025.

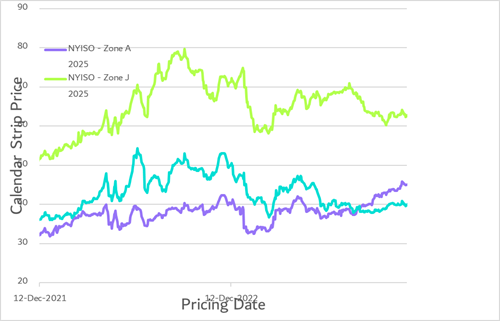

The power market has responded by shedding much of its winter premium with the calendar strips following suit. Prices in PJM have come off $3-4 with most decreases in the winter months. Who would have thought the best buying opportunity would be in December? Even without any bullish news in sight, now would be a great time to take some off the table to hedge against the unexpected.

The storage expectation for the week ending December 8this for a withdrawal of -50 BCF, which is 30 BCF below the 5 year average.

Regulatory Report:

Kuwait Defies Calls for Fossil Fuel Phaseout at COP28, Advocates Emission Cuts Instead

Kuwait's oil minister, Saad al-Barrak, rejected calls for a fossil fuels phaseout at the COP28 UN climate change summit in Dubai on Dec. 12. Al-Barrak emphasized the need to focus on cutting greenhouse gas emissions while suggesting that "new technical and control solutions" could achieve emissions control. He argued that abandoning fossil fuels would pose significant challenges to the energy sector and hinder development.

Al-Barrak's stance aligns with OPEC's secretary general Haitham al-Ghais, who urged oil-exporting nations to resist targeting fossil fuels instead of emissions. Notably, the COP28 Global Stocktake draft text on Dec. 11 omitted references to the phaseout of oil and gas but emphasized the importance of reducing fossil fuel consumption and production in an equitable manner, aiming for net-zero emissions by or around 2050.

Kuwait's rejection mirrors similar sentiments from OPEC heavyweights Saudi Arabia and Iraq. Iraq, the second-largest OPEC oil producer, expressed its commitment to emissions reduction but rejected fossil fuel phaseout. Saudi Arabia, despite pledging net-zero emissions by 2060, opposed calls for fossil fuel phaseout in the lead-up to the COP28 draft text.

Climate activists criticized these positions, asserting that the vague commitment to reducing fossil fuel consumption and production by 2050 reflects the fossil fuel industry's influence on global policies. They warned that failing to take decisive action at COP28 could lead to catastrophic consequences and push global warming beyond the critical 1.5-degree Celsius threshold.

US Offshore Wind Plans Altered: Maryland Excludes 80,000 Acres, Focus shifts to Virginia and Delaware

The US Interior Department's Bureau of Ocean Energy Management (BOEM) has excluded nearly 80,000 acres off the coast of Maryland from the proposed offshore wind lease sale in the Central Atlantic, citing extensive costs for mitigating the effects of wind development. The B-1 area's removal is due to concerns related to the heavily trafficked Maryland coastline, including military and commercial vessels and the NASA satellite launch facility. The Defense Department expressed potential interference with defense radars and missile defense systems if wind facilities were operational in the region. However, BOEM mentioned that the area might be considered for a second lease sale after the 2025 presidential election.

The proposed lease sale for the Central Atlantic, scheduled for mid-2024, will now only include two areas offshore Delaware and Virginia, totaling nearly 278,000 acres. The largest area, comprising 176,505 acres, is located offshore Virginia, with the other area consisting of 101,443 acres near Delaware Bay. BOEM is seeking public input on whether these areas should be part of the lease sale, with public comments to be accepted until December 12. The agency has also completed the environmental review of the Orsted-Eversource proposed Sunrise Wind facility offshore Massachusetts, Rhode Island, and New York, reducing the number of turbines from 94 to 84 to address environmental concerns.

FERC Faces Transition as Danley Expected to Exit, Three-Member Panel to Navigate Energy Policy Challenges

FERC (Federal Energy Regulatory Commission) member James Danly, who has not participated in commission orders since Nov. 21, is expected to exit the commission in the coming weeks. With his term officially expiring in June and no public announcement of his plans, it is anticipated that Danly will step down after Congress adjourns. Departing FERC members often refrain from participating in certain cases while pursuing future employment opportunities. The three-member panel, led by Democrat Willie Phillips alongside Democrat Allison Clements and Republican Mark Christie, is expected to remain productive through the first half of 2024. Despite lacking a full complement of five members, observers believe the three members will work well together, with Phillips known for seeking consensus. The panel is expected to address transmission planning, interconnection, transmission cost allocation, and power market reforms in the coming months. Concerns about losing a quorum, as experienced during the Trump administration, have been raised, but it is not expected to occur in 2024, considering Clements' term runs through June 2024. The White House is anticipated to nominate candidates to fill vacancies in the near future.