Smartest Insight | Issue 88

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

June 23, 2022

Market Update:

The prompt Nymex contract is off $2.40 over the last 10 days. The move down was prompted by the news that the Freeport LNG facility would completely offline for 90 days (originally thought to only be three weeks) and would not have a complete return to service until late 2022. The catalyst for the follow thru to the downside has been two consecutive storage builds that were above expectations. While gas is off significantly during that time power has remained relatively flat with the front contracts only off around $5. With the news of the Freeport outage, end of season storage estimates have increased from slightly above 3.3 Tcf to just over 3.5 Tcf which if achieved would leave storage levels within 120 Bcf of the five-year-average.

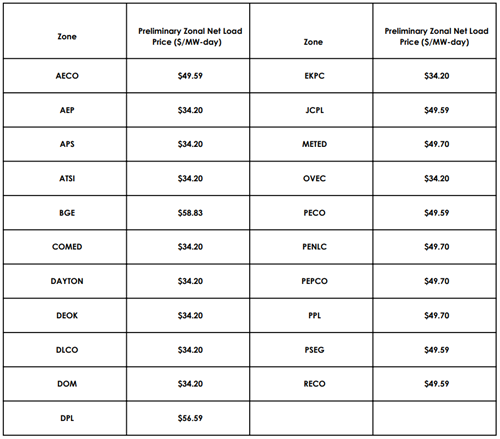

On the capacity front PJM released the results of the 2023/2024 BRA. The auction clears were below the previous year for all regions. The lower clear can primarily be attributed to a lower peak load forecast YoY. Below is a table summarizing the results:

Regulatory Report:

EIA SHORT TERM OUTLOOK

On June 16, 2022, the US Energy Information Administration published its short-term outlook for June. Key findings are:

- Wholesale power prices are expected to significantly increase between 18% to over 200% year on year, mostly due to higher fuel costs. EIA forecasts that Northeast ISO prices will exceed $100/MWh between June 2022 and August 2022, about double the prices from last summer.

- EIA expects Henry Hub natural gas to average $8.69/mmBtu from July-September 2022, compared to prices of $2-$4/mmBtu during the same period last year. EIA listed three factors causing natural gas prices to rise, i.) natural gas inventories that are below the five-year average, ii.) steady demand for U.S. LNG exports, and iii.) high demand for natural gas from the electric power sector due to dwindling opportunities for natural gas-to-coal switching.

- Henry Hub prices are expected to average $4.74/MMBtu in 2023 due to rising natural gas production.

- EIA estimates that natural gas inventories at the end of October will rise to 3.3 Tcf, about 9% below the five-year average.

- EIA forecasts U.S. dry natural gas production to average 97.9 Bcf/d from July-December 2022, about 3% higher than the amount produced from July-December 2021.

- EIA forecasts that continued coal generator retirements mean that coals share of U.S. electric generation will decline from 23% in 2021 to 21% in 2022 and to 20% in 2023. Coal plants fleet are facing constraints such as limited rail capacity for fuel delivery, low coal inventories at power plants, reduced coal mining capacity, and rising generation from renewable sources.

BROKER REGULATION BILL PASSES NY HOUSE AND SENATE

On June 3, 2022, NY Bill S9414 passed the House and Senate and is now awaiting governor Hochul’s signature.If signed, this bill would impose significant regulations on energy brokers and consultants. Key provisions are:

- Energy Broker is defined as "an entity that assumes the contractual and legal responsibility for the sale of electric supply service, transmission or other services to end-use retail customers, but does not take title to any of the electricity sold, or an entity that assumes the contractual and legal obligation to provide for the sale of natural gas supply service, transportation or other services to end-use retail customers, but does not take title to any of the natural gas sold."

- Energy Consultant is defined as "any person, firm, association or corporation who acts as broker in soliciting, negotiating or advising any electric or natural gas contract, or acts as an agent in accepting any electric or natural gas contract on behalf of an ESCO."

- Energy Broker applicants must post a $100,000 bond and Energy Consultant applicants must post a $50,000.

- Each registered energy broker or energy consultant must annually pay the NYPSC a $500 registration fee.

- Energy brokers and energy consultants must disclose their form and amount of compensation to customers via a conspicuous statement on any such contract or agreement between the energy agent, Energy Consultant, Energy Broker or energy intermediary and its customer.

- If an ESCO collects broker compensation on behalf of an Energy Broker or Energy Consultant, such broker compensation must be added as a provision to the customer disclosure label in the customer contract.

Company News:

We just wanted to shout out a special thank you to those of you who attended our Happy Hour event at TEPA Boston earlier this week.

The Boston Tea Party Ships & Museum was such an amazing venue to host everyone! It was a pleasure getting to connect and we look forward to continued business and seeing everyone at the next TEPA event!