Smartest Insight | Issue 89

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

June 30, 2022

Market Update:

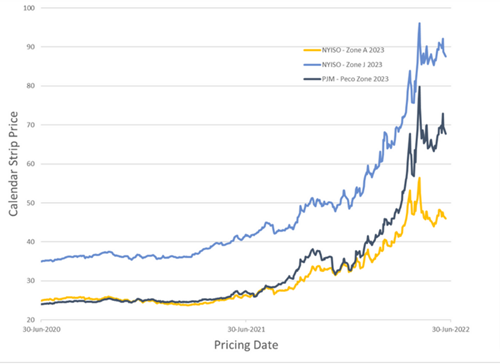

Storage for the week ending 6/24/2022 came in at the top end of consensus estimates. This marked the second larger than expected build in inventories in as many weeks. The impact of Freeport’s outage has likely been underestimated by the market and it will be important to watch as we progress through the summer months. As we now have visibility into the first half of July weather the risk premium for the prompt month has come off dramatically over the past two weeks. On-peak PJM West Hub is off over $90 and On-Peak NYISO Zone G is off $40. These moves have also brought the forward curves down but not to the same degree. If there is any uptick in production that market will have more room to the downside but we have yet to see that YTD.

3 year view of the calendar strip price

Regulatory Report:

PJM EXPLAINS JUNE 13 PRICE SPIKES

On June 29, 2022, at its Markets and Reliability Committee meeting, PJM provided information related to the real time price spike that occurred on June 13. Key points are as follows:

- On Monday June 13, PJM expected a peak demand of approximately 128,000 MW. PJM expected that it had sufficient generation resources for the day.

- PJM drastically under forecasted the temperatures throughout its region for June 13. By mid-day, the peak load was about 8000MW higher than PJM had forecast.

- In the early afternoon, PJM lost power generation totaling 1150MW.

- Shortly after losing the generation capacity, PJM also experienced an unexpected overload on the Peach Bottom-Conastone 500kV transmission line. This transmission constraint required PJM to reduce the output of generation upstream of the constraint.

- In order to meet demand, PJM had to turn on a number of high-priced combustion turbines that operate infrequently. As a result, real time prices spiked to more than $3000/MWh.

- PJM’s presentation from the Markets and Reliability Committee meeting is located via the link below.

PLAQUEMINES LNG PHASE I

On May 25, 2022, Venture Global LNG announced that it has taken a final investment decision (“FID”) and successful closed $13.2 billion in project financing for its’ Plaquemines Phase One LNG facility. Plaquemines Phase One is the first U.S. LNG export project to achieve financial close since Venture Globals’ Calcasieu Pass facility in 2019. Plaquemines has received all necessary permits, including authorizations from FERC and DOE.

The U.S. has 7 operating LNG export projects that have the capacity to export approximately 13 BCf/day of natural gas. An additional 3 projects, totaling 4.9 BCf/day are under construction and will likely be on-line by 2024. An additional 10 projects representing 17 BCf/d are permitted and could take FID in the next 2 years. Once an owner takes FID, it takes roughly 24-30 months to bring an export project on-line. Given the massive spread between U.S. and European gas prices, the U.S. could see its LNG exports more than double in the next 3-5 years.

Company News:

SmartestEnergy is thrilled to announce that in under 3 short years we have cracked the top 25 NonResidential suppliers in the country! This ranking is released by DNV and we are so proud of all of our employees, and partners for the hard work it took to get us here. We can't wait to continue to put in our very best effort and see how high we can climb the list for next year!

Happy 4th of July!! We just wanted to send out a quick message about our hours for the holiday weekend. We will be stopping all pricing and contracting at 1pm Friday, July 1st and will be completely closed by 2pm. We will be closed for business Monday, July 4th. Enjoy the long weekend!