Smartest Insight | Issue 94

Our weekly company round-up covers the key market and industry news in one place, so you don’t have to look any further to stay ahead.

September 23, 2022

Market Update:

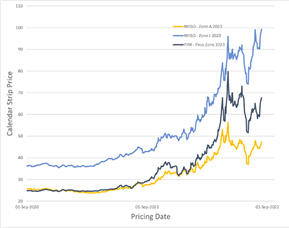

The EIA reported an injection of 103 Bcf for the week ending 9/16/2022. This was the largest injection of 2022. The result exceeded consensus forecasts for an injection of 92 Bcf. The prompt contract was off $0.30 on the day and continued the down trend that start a week ago which started off of the news that the potential rail strike had been avoided easing concerns of coal shortages and increased coal to gas switching. That’s the story in the front part of the curve, the back part of the curve has also been under pressure off the news that Tellurian has scrapped fundraising plans for their Driftwood LNG project in Louisiana. Market participants are likely forecasting less LNG demand in Cal26 and beyond due to reduced probability of the Driftwood project which has a proposed nameplate capacity of 3.6 Bcf/day of export capability.

PJM BLACK START RULE CHANGES

PJM stakeholders have been working on proposed rule changes for generators that provide black start service to the ISO. PJM’s tariffs require it to procure black start service from generators that have ability to restart the power grid after a blackout. The revised rules will place new fuel assurance requirements on the generators providing black start service. These rule changes were prompted by PJM’s concern that it could be prevented from restarting the grid quickly after a black out if resources designated to provide black start service were unavailable due to lack of fuel. The proposed rule changes will require that each transmission owner zone be required to have at least one fuel-assured black start resource site per zone. PJM expects that the revisions will be voted on by stakeholders at the Markets and Reliability

Committee in October and the

Members Committee in November. The costs for black start service are charged to retail electricity suppliers, and ultimately passed on to customers.

NY PSC APPROVES 600 MW OF WIND, SOLAR PERMITS

On September 15, 2022, the New York State Public Service Commission (“NYPSC”) approved construction or operating permits for 600MW of solar and wind projects, totaling a combined 600 MW. Two 120MW wind projects in Steuben County and a 280MW solar project in Genesee county were among those approved. New York State has goals to obtain 70% of its generation from renewable sources by 2030 and zero carbon emissions from the grid by 2040. The approved projects likely have Tier 1 REC contracts from NYSERDA, the costs of which are charged to electricity suppliers, and ultimately passed on to customers.

U.S. SETS 15 GW TARGET FOR FLOATING OFFSHORE WIND

On September 15, 2022, the Biden administration announced a target of 15 GW of floating offshore wind capacity by 2035 and create a Floating Offshore Wind “Shot”, an initiative to reduce floating technology costs by more than 70% by 2035 to $45/MWh.By creating this initiative, the administration is looking to de-risk the technology by accelerating breakthroughs in engineering, manufacturing, and other innovation areas. Northeast U.S. states have signed long term contracts for more than 17 GW of offshore wind projects, all of which will be “fixed bottom” rather than floating projects. that will come on-line over the next several years, beginning in 2023.

Globally, just 0.1 GW of floating offshore wind has been deployed to date, compared with more than 50 GW of fixed-bottom offshore wind capacity.

RAILROAD STRIKE AVERTED

On September 15, 2022, management and unions representing 50,000 engineers and conductors reached an agreement averting a railroad strike that had threatened to cripple US supply chains and cause chaos in the natural gas and power markets. According to the US Energy Information Administration (“EIA”), coal fired plants produced 22% of all electricity generation during 2021 and most of that coal was delivered to generator sites by rail. Any interruption of coal fired generation caused by a strike would be replaced primarily by natural gas fired generation. In its September short term outlook, EIA reported that natural gas inventories ended August 12% below the five-year average but expected inventories to rebound to only 7% below the five-year average by November 1. Natural gas markets were volatile after the news but end of day prices were not materially different than opening quotes.