Posted on: 13/06/2023

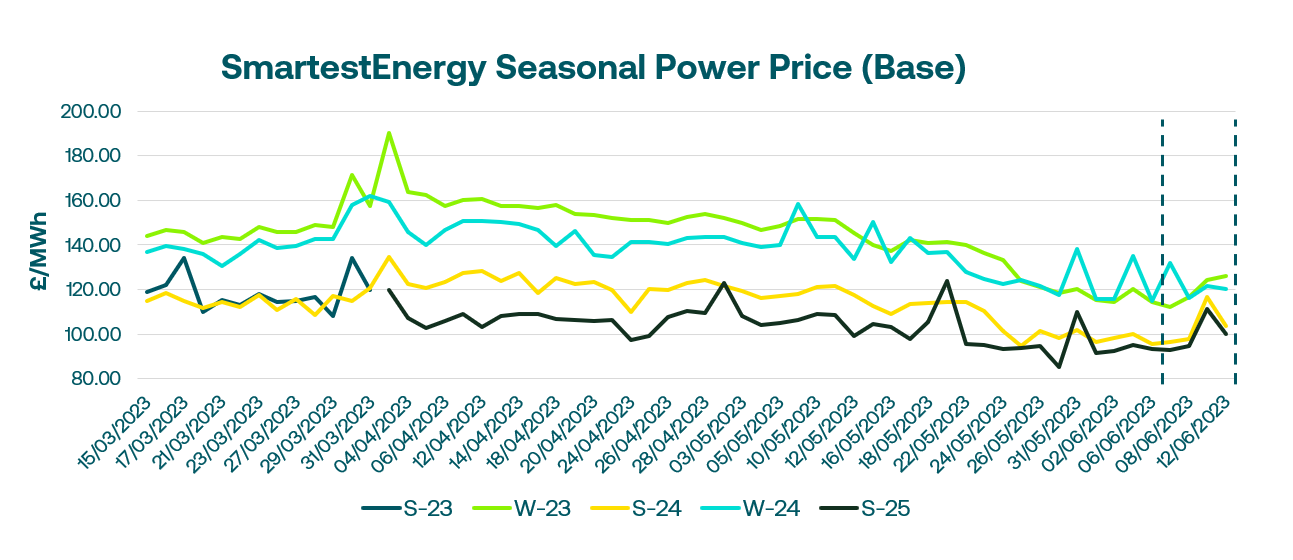

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 6th June - 12th June 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £126.06/MWh for the Winter-23 seasonal power price on 12th June. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday’s market trend was short-lived, with low trading volumes for gas and power indicating a slight uptick and closing out risks. However, the underlying fundamentals remained healthy, characterised by high storage levels and gas consumption forecasts approximately 30% below seasonal expectations for the upcoming month.

European gas market continued to show weakness, and storage levels are being filled in preparation for the upcoming winter. European storage was nearly 70% full. However, there was still a risk of energy shortage in Europe this winter, depending on factors such as the return of Asian LNG demand and temperatures. UK LNG import volumes may decline to an 11-month low due to high stocks and low seasonal demand, potentially reducing purchase requirements.

EDF's latest availability schedule for French nuclear reactors confirms delays and maintenance extensions, raising the risk of further delays into Q4. Winter contract (Q1-24) prices rose by 7%, settling at €171.50/MWh, a 5% gain. Continental gas (TTF) and UK power and gas prices also rallied.

The week ended with a volatile Friday. European gas prices surged by 20% to a three-week high due to Norwegian outages and a potential short squeeze. LNG prices in Europe rebounded to align with Asian prices. Strong gas and carbon markets drove UK power prices higher, with front quarter and winter contracts reaching a two-week high, gaining £9/MWh. To address concerns about the Energy Profits Levy impacting oil and gas investment, the UK government introduced a price floor for windfall tax.

Power markets experienced thin liquidity yesterday. As the day progressed, gas prices saw a slight decrease, while limited liquidity in the power market resulted in a gain for July Baseload at the close of the day.

United States

United States Australia

Australia