Posted on: 06/06/2023

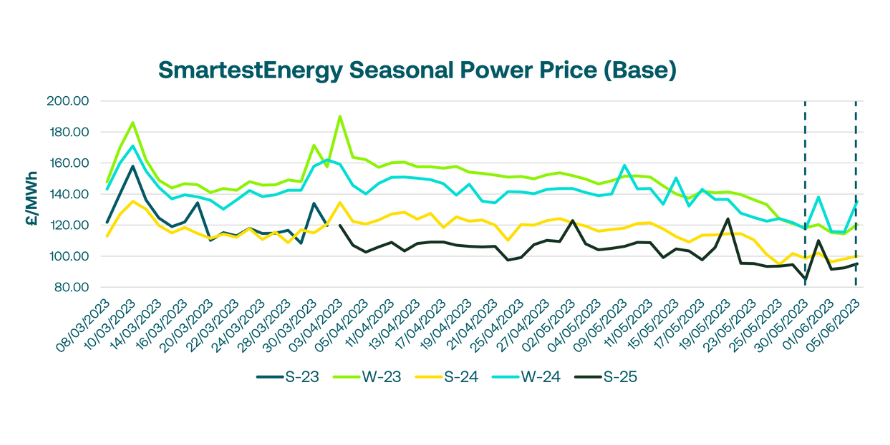

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 30th May – 6th June 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £ 120.38/MWh for the Winter-23 seasonal power price on 31st May. In this blog, Fanos shares the market news and updates from the last week.

Trades on the UK power market started slow last Tuesday, with the first trade for Winter-23 only registering at midday, and thereafter the rest of the front season volume trading in the last 2 hours of the day, with 51MW registered in total for UK Baseload Winter-23.

LNG send-out across the UK and Europe were reduced, and Norwegian flows into UK and Europe also remained subdued amid soft demand. However, European gas bounced back mid-week, possibly as a signal to attract LNG supplies following the high volumes of LNG shipments going to Asia the previous week. Power also recovered on the back of the firm gas and emissions markets.

Into the week, news from Equinor of a gas leak at their LNG plant at Hammerfest in Norway triggered some supply concerns. However, work overnight saw the leak curtail and operations at the plant normalise causing the market to trade back down the following day. Higher than seasonal normal temperatures, high storage inventories and softer demand also weighed on front-month prices, compounding losses across all forward power and gas prices.

As we move into June, the renewables forecast for the month is expected to be very strong, with the latest expectations indicating a higher-than-average outturn. Currently, fundamentals remain unchanged, but low LNG send-out and continued maintenance work reducing supplies support prices.

United States

United States Australia

Australia