Posted on: 14/02/2023

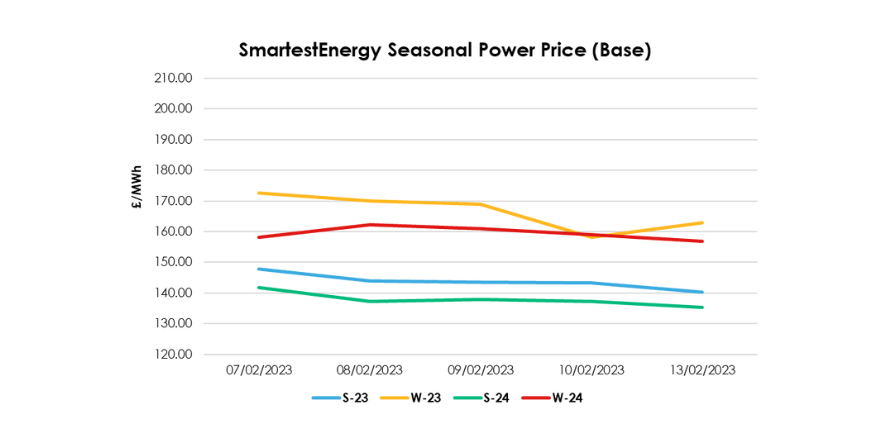

Head of Sales Trading, Fanos Shiamishis, reports on the energy market activity, covering the period 7th – 14th February 2023. On our end-of-day pricing tool, the Source, we published an in-week high of £147.76/MWh for the Summer-23 seasonal power price on 7th February, reducing to £140.25/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday, latest temperature forecasts reverted to above seasonal average with a 4oC temperature rise across the rest of the week. A high wind power forecast weighed on prompt UK power prices while forwards tracked the easing NBP and TTF gas price as supplies remained strong. French union strikes remained a threat to power supplies with reports citing a 6.3% reduction in capacity and the shutdown of schools and public transport also reduced demand.

Summer 23 NBP declined by 18 ppth last week. Healthy storage levels and strong supply added downward pressure. However, energy prices reducing gives a signal to restart or increase some high energy consuming production that was paused or reduced earlier.

Latest gas consumption forecasts edged higher whilst temperature expectations remain relatively unchanged day on day. Q2-23, Summer 23 and Winter 23 UK Baseload power saw a combined 728MW traded across all three contracts indicating the easing of credit constraints across the industry.

Yesterday, prices decreased amid milder weather forecast and increased Norwegian flow. Flow to the UK rose from 47 mcm per day on Thursday to 87mcm. Troll gas field in the Norwegian sector of the North Sea was back after an unplanned outage. Other European destinations receiving more Norwegian gas as well, but the increase to the UK is the most significant. US Freeport LNG terminal has started to resume operations since it was shut by a fire back in June 2022, however, is it not expected to return to full commercial operations for months.

United States

United States Australia

Australia