Posted on: 07/02/2023

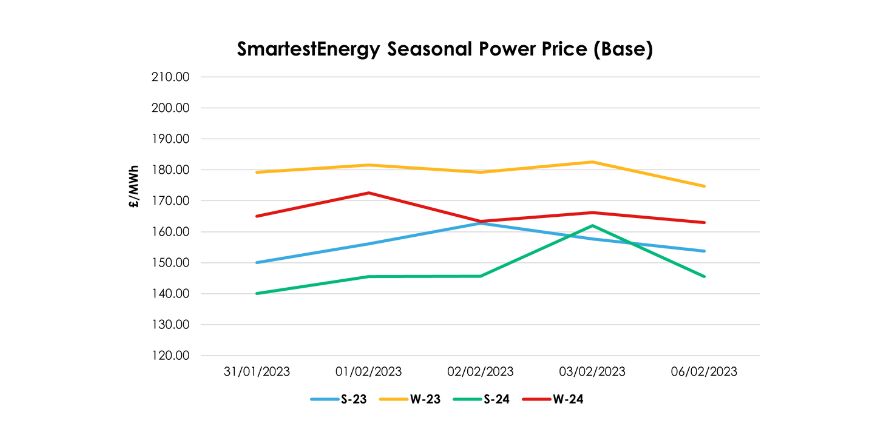

Head of Sales Trading, Fanos Shiamishis, reports on the energy market activity, covering the period 31st January – 6th February 2023. On our end-of-day pricing tool, the Source, we published an in-week high of £162.76/MWh for the Summer-23 seasonal power price on 2nd February, reducing to £153.76/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Gas prices were up at the start of last week, with unplanned outages at the Norwegian Kollnes gas plant and delayed deliveries from the Freeport LNG exporting facility adding upward pressure. As the week progressed, NBP and TTF traded lower as LNG supply picked up to replace low Norwegian flows.

Throughout the week, the UK power curve was down day on day, and liquidity remained low. We saw little interest on the near curve, with most near-term contracts not trading until late afternoon. Interest was noted on the far curve up to Summer 26, which traded at £97.50/MWh on Thursday.

As we reached the end of the week, on Friday, European gas bounced back up on the back of the colder weather forecast, and UK power followed the bullish NBP trend.

This week gas has opened softer, following a bearish signal from strong LNG supplies and flat Norwegian flows.

UK gas for power demand is up as the colder weather and limited wind output expected in the next two days adds pressure. However, healthy supply levels prevent prices from going up in the long run. This week, UK power followed, trading up to £5/MWh lower across the curve

United States

United States Australia

Australia