Posted on: 10/10/2023

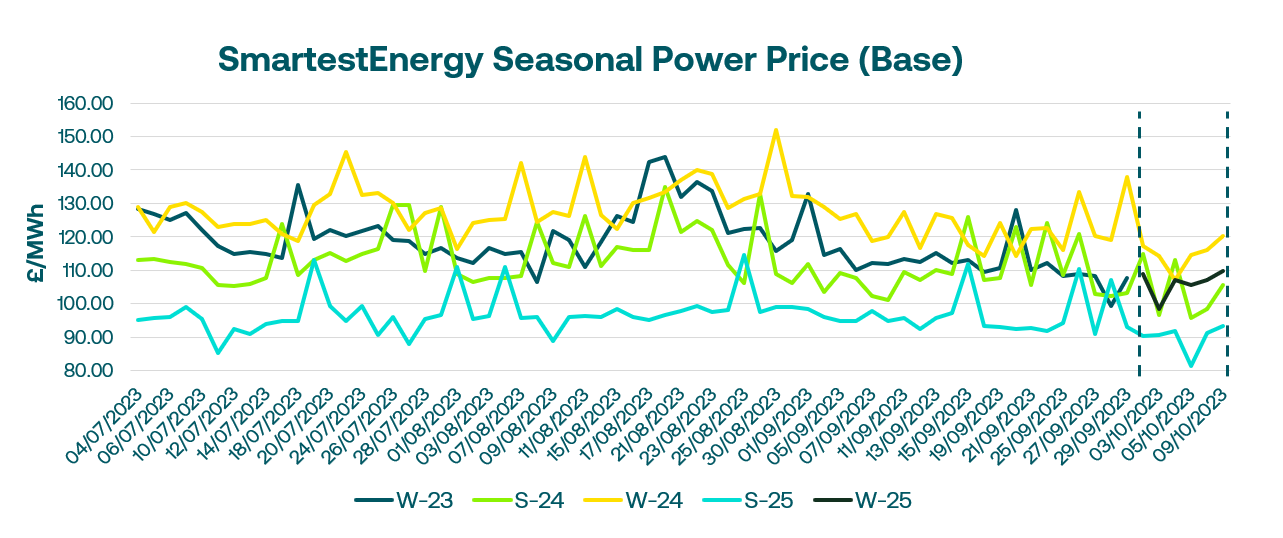

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 3rd October – 9th October 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £109.75/MWh for the Winter-25 seasonal power price on 9th October. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday started with a decline in gas prices, however, there were no fundamental drivers as the gas system opened the day marginally short. Initially, a rally in the UKA market seemed to prop electricity prices early in the day only for gains to reverse by the end of the day.

There was a bounce back observed on Wednesday, following the previous losses, driven by the TTF and EUA markets. The trend was reflected in the NBP market as well. In the short term, the UK gas system started the day with minimal changes, opening flat, with only a slight shortfall of 2mcm. TFF front month rose to the highest level since 25th September to €44.615/MWh.

The BBL pipeline connecting the Netherlands and Britain reverted to importing towards the UK. As a result, there are currently no flows through the pipeline to continental Europe, as it has limited capacity to switch modes and can only do so a few times a year. European gas supply hit a record high going into winter 2023-24. With storage facilities full to maximum capacity, reaching 96%, this is the second-highest record since 2019. In response, UK power prices have declined, with a drop of over £1/MWh on the market curve, and liquidity in the market remains subdued.

On Friday morning the markets opened with news agencies reporting of the Australian LNG workers union, Offshore Alliance, advocating for industrial action. The surge in gas prices observed in the TTF and NBP markets was linked to the short-term supply concerns stemming from this development, especially for the remainder of the winter season. Alongside the potential supply risks, the weather forecast indicated that temperatures are moving closer to the seasonal norms for the second part of October, suggesting an increase in heating load demand.

Monday saw NBP and TTF experiencing an upward trend. Several bullish factors contributed to this, including favourable such as the risk of renewed industrial action at Chevron facilities in Australia, Middle East tension, and the predictions for colder weather in the upcoming months. Additionally, a leak was identified on the Baltic connector gas pipeline, which is expected to take a few months to repair. This subsea pipeline played a crucial role in balancing the gas supply between Finland and the Baltic nations.

Norwegian nominations for gas supply to the UK were lower. In the UK power market, trading activity was primarily focused on the front two months, front quarter, and season contracts, with less than 30 MW traded.

United States

United States Australia

Australia