Posted on: 17/10/2023

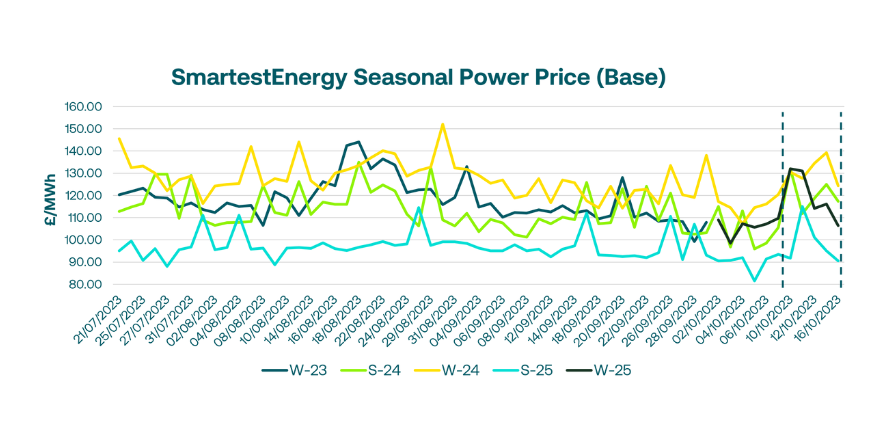

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 10th - 17th October 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £132.00/MWh for the Summer-24 seasonal power price on 10th October. In this blog, Fanos shares the market news and updates from the last week.

Early last week, the energy complex rallied strongly as the conflict in the Middle East continued, Australian LNG workers strike risks renewed, and ongoing claims that Russia was behind the leak on the BalticConnector gas pipeline. The UK gas system opened short but was balanced by higher Norwegian exports, and power was also firm, with the short-term spark spread trading almost £3/MWh higher amid bullish EU and UK carbon markets.

On Wednesday, recent gains abated as the fundamental outlook saw stable supplies and high inventories meet forecasted demand across the UK and Europe. Further into the week, power and gas opened higher, reaching a three-week high, with November-23 NBP returning to a level not seen since August-23. Increasing Norwegian flows and higher wind output did little to offset bullish geopolitical risks, as trading on the power curve increased with the main focus on the balance of Winter.

On Friday, we saw another lively day for European energy markets, with front-month gas prices reaching an 8-month high on the back of colder weather forecast, the ongoing prospect of renewed Australian LNG strikes and unstable geopolitical tensions in the Middle East. Analysts worried that Europe’s subsea infrastructure was vulnerable following two sabotages over the past year, causing UK power prices to climb.

This week, the UK gas system opened long yesterday, with a correction for both NBP and TTF amid stable supply, full storage and warmer weather ahead. Smaller volumes than last week traded on the UK power curve, with front months and front two seasons declining the most, whilst Winter-25 and Summer-26 reduced by £1/MWh in comparison to Summer-24 which declined by more than £6/MWh.

United States

United States Australia

Australia