Posted on: 24/10/2023

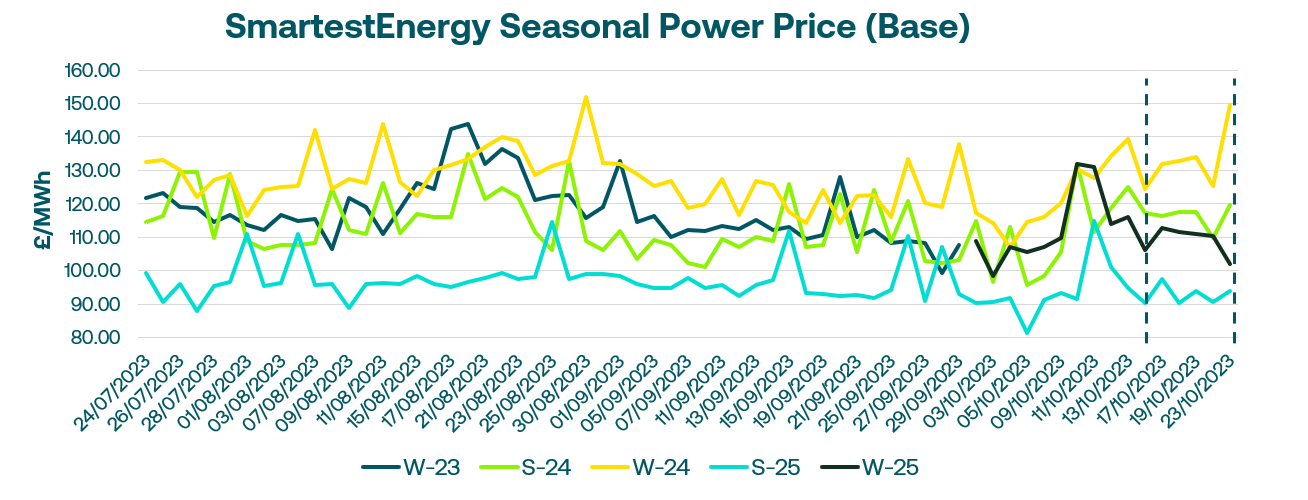

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 17th October – 23rd October 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £119.77/MWh for the Summer-24 seasonal power price on 23rd October. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday the UK gas system faced a 23mcm supply shortage, which led to increased reliance on LNG and storage withdrawals. European gas prices initially dropped due to a milder weather forecast but climbed back to flat as geopolitical events dominated world news. Fundamental outlooks include forecasts from Atmospheric G2 predicting a mild November and December, followed by a colder than usual January and February. The UK entered winter with storage at 98% capacity, but potential upside risks remain if contrary to forecast we see a sustained cold snap coupled with LNG shipments diverting to Asia.

National Balancing Point (NBP) and Title Transfer Facility (TTF) prices saw an upward trend on Wednesday, driven by gas field outage news (Tamar and Leviathan) linked to Middle East security concerns. Locally, the morning started with a balanced UK gas system, and Norwegian gas flow to the UK saw an increase. In the UK power market, only 2 MW traded beyond Winter-24. The contract (Win-24 Baseload) registered over 300 MW of trades gaining £4.25 per MWh day-on-day.

On 19th October the UK gas system opened with a deficit of 11.5 mcm/d, with Norwegian flow nominated lower and an increase in LNG sendout nominations by 8mcm/d. The front season gas narrowed the gap that had emerged on the previous day. UK power trading observed a decline, primarily influenced by a softening UKA market.

On Friday, the UK gas system was stable, with an increase in Norwegian gas flow to the UK. In the morning, NBP prices increased due to a colder weather outlook but later dropped as the supply remained strong.

Traders turned their attention to the reports from Finland's National Bureau of Investigation focus on the role of the Hong Kong registered vessel "Newnew Polar Bear" in the inquiry into the damage sustained by the Balticconnector gas pipeline.

This week European gas prices saw a decline in last weeks risk premium, driven by a more favourable weather forecast and healthy supply, offsetting the impact of geopolitical risks. The UK gas system commenced with an 8mcm undersupply, primarily attributed to reduced Langeled flows to the UK. In the UK power market, trading remained relatively stable, with the front-month contract being the most actively traded, witnessing an exchange of 300 MW.

United States

United States Australia

Australia