Posted on: 16/01/2024

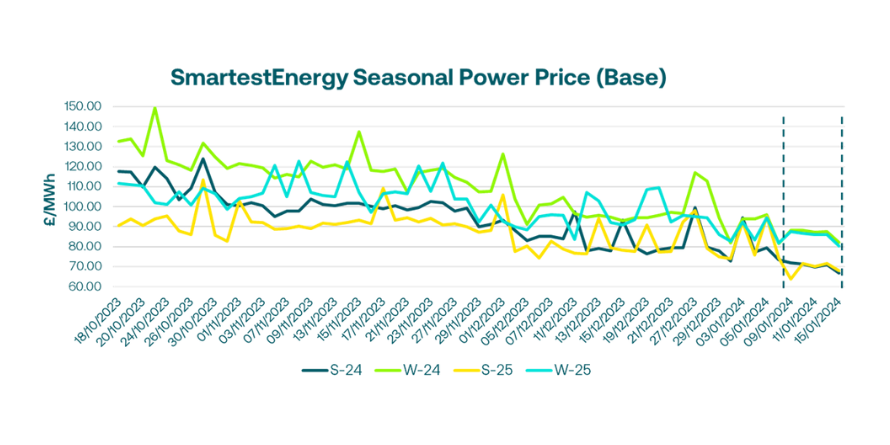

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 9th – 15th January 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £ 72.05 MWh for the Summer-24 seasonal power price on 9th January. In this blog, Fanos shares the market news and updates from the last week.

Last week, European gas prices came off amid abundant supply as gas flow from Russia at Velke Kapusany was up 40GWh/d and expected return of milder and windier conditions. Weak Asian demand for LNG added some downward pressure. UK power traded lower across the board with Winter-24 contract almost trading 160MW total.

On Wednesday, the UK gas system opened 5mcm long this morning with supplies stable from Norway. The UK/BE interconnector reverted to import from the continent amounting to additional 6mcm supply. Analysts cited a year on year 6.7% reduction in Norwegian production during 2023 whilst December exports hit an all-time high. Extensive maintenance outages were cited, whilst some of the investment had the impact of increasing capacity which enabled an all-time high in December delivery of 11.1 bcm. The previous high was recorded in January 2017 at 10.9 bcm.

European gas prices seem to have bounced back from a local bottom (75pp/th on NBP, €30/MWh) on comfortable supply and waning demand. Storage levels remain healthy and although the cold spell is lasting until the end of this week, warmer forecast is expected after that.

Friday saw volatile intraday market with TTF gas opening strong in reaction to overnight Middle East military operations setting a bullish sentiment. Supply remained strong with no change to the demand outlook in the near term. Geopolitical risk remains dominant with expectations that escalating tensions may well impact the transportation of energy albeit plentiful in supply.

Yesterday, the UK gas system was short in the morning, but the bearish sentiment prevailed due high storage levels despite recent withdrawals. LNG deliveries this week are not likely to be as high as last week as the demand is lower amid milder weather forecast ahead.

United States

United States Australia

Australia