Posted on: 07/11/2023

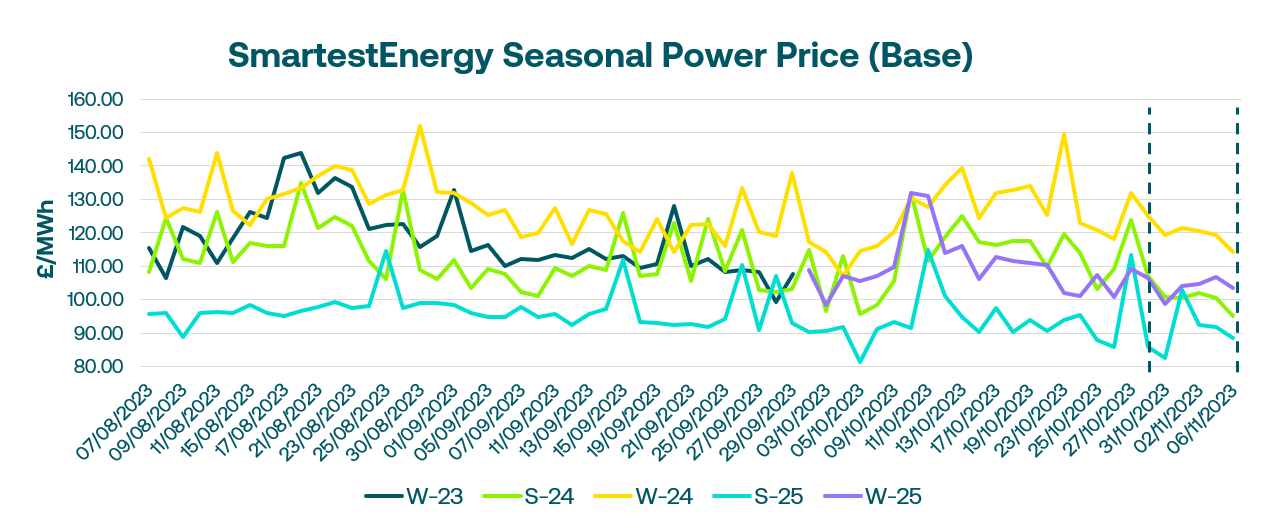

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 31st October – 6th November 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £102.08MWh for the Summer-24 seasonal power price on 2nd November. In this blog, Fanos shares the market news and updates from the last week.

Earlier last week the UK gas market witnessed a 5% decline in prices, driven by factors such as mild weather, high gas storage and “oversupply”. In addition, the Transmission System Operators (TSOs) in Finland and Estonia have confirmed that the Baltic interconnector, which recently suffered damage, will remain out of operation for approximately five months. Continental traders rolled out hedges against the news, with speculation of delays to the timescale. This was noted in the UK power market, where the trading of Winter-24 Baseload was the most traded product with 211MW exchanging hands.

The supply of power and gas has been positively influenced by milder temperatures, which have led to reduced demand projections for mid-November. Additionally, the strong wind conditions led to a decrease in the Day-Ahead power prices for the week.

Last Thursday started with a balanced gas system and an increase in the Norwegian gas supply. Although there was a growing demand for heating, the supply remained strong. The National Balancing Point (NBP) gas market slightly increased prices as the day progressed, ending with modest gains. Wind power generation was partly restricted due to safety concerns arising from the storm Ciaran.

European natural gas prices experienced a decline on Friday, influenced by mild weather forecast and nearly full storage capacities across the continent. However, there are still some potential upward price risks associated with tensions in the Middle East. In the UK power market, trading activity was limited, with only the front four seasons trading, all of which saw lower prices across the board, due to the weakness in gas and carbon.

This week the gas curve continues to see a decrease in prices, driven by reduced demand, full storage, and strong renewable output. Additionally, there has been an increase in LNG deliveries to Europe. In the UK power market, on Monday the trading focused on December-23 and Q1-2024.

United States

United States Australia

Australia