Posted on: 14/11/2023

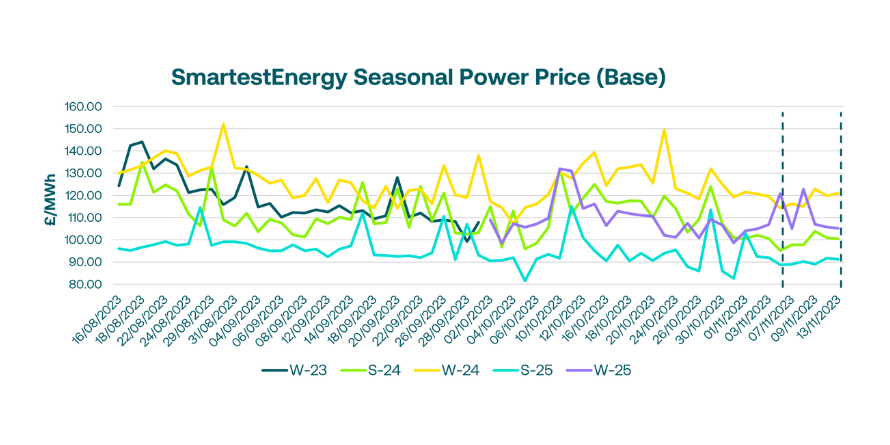

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 7th – 13th November 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £103.75 MWh for the Summer-24 seasonal power price on 9th November. In this blog, Fanos shares the market news and updates from the last week.

Early last week, we saw a slight rebound in prices, but fundamentals remained bearish, with healthy gas storage levels and forecasted temperatures above seasonal norms. UK base power reported a small upwards correction, underwritten by a rallying UKA market reaching a 10-day high, and day ahead base contracts cleared higher, driven by firmer gas NBP.

On Wednesday, UK power markets opened weaker and traded down to £96, however, some recovery was made in the afternoon, returning to within 0.5% of the previous day’s closing levels. Into Thursday, the recovery continued, as we saw both gas and power curves rise, following the near term prices, gaining amid higher demand for heating.

Despite the strong storage levels and stable LNG deliveries, the combination of lower renewable output with the colder weather forecast added upward pressure to prices. The N2EX Day Ahead power price cleared at its highest price this month at £96.99/MWh, and the UK gas system opened long.

At the end of the week, LNG send-out was nominated higher, and European gas fell on healthy supply amid a warm and windy outlook. UK power traded lower across the curve as gains in the carbon market were not enough to counter the bearish gas move. With the main focus on the winter balance, we saw very low liquidity on seasonal products, whilst the front month and front quarter traded 265MW and 157MW, respectively.

This week, both NBP and TTF started the week trading lower amid milder weather, strong wind output and high inventory levels with more LNG supply on the way. Meanwhile, we saw minimal interest on the UK power curve, with December-23 trading in less than 60MW, while W24 did not trade at all.

United States

United States Australia

Australia