Posted on: 30/01/2024

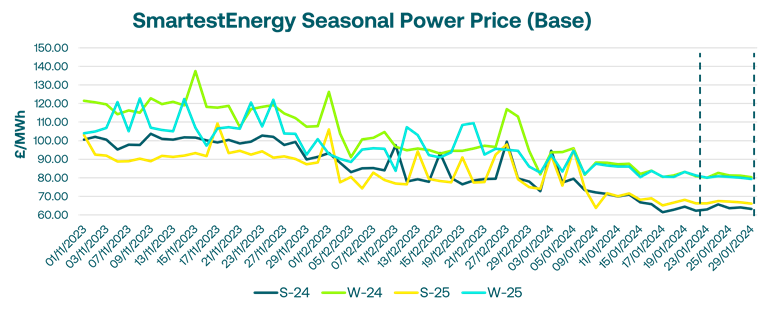

Sales Trader, Jean-Philippe Marty, reports on energy market activity, covering the period 23rd – 29th January 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £65.75/MWh for the Summer-24 seasonal power price on 24th January. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday, the UK gas system opened long, with prices expected to rise amid higher Norwegian flows and LNG send-out. European gas also opened higher but failed to hold steady and pared all gains, approaching a 6-month low once again as mild weather and strong supply remained. UK Power was also bearish, but the move was counterbalanced by a slight recovery in the emissions market.

Into the week, European gas prices corrected after oversold conditions, but strong supply and tepid demand limited the upside. Meanwhile, a recovering carbon market helped push power higher, with the front-month baseload contract up 6% as the most liquid product of the day, with a total of 165MW traded.

On Thursday, the Red Sea Crisis continued to cause delays to LNG shipments as Qatar rerouted its cargo around Africa via the Cape of Good Hope. However, the delays were offset by strong inventories and had no impact on prices.

At the end of the week, gas traded lower in the morning before a corrective rally in the afternoon to bounce back and closed almost flat to the previous day. Norwegian flows were lower, and strong renewable output reduced gas for power demand. On the UK power curve, more than 400MW of the February-24 contract changed hands, and we saw no interest beyond Winter-25.

This Monday, European gas opened the week higher, but gains were capped by mild weather and healthy storage levels. UK Power traded sideways with no clear trend, to finally close slightly down due to a weak UKA market. The most traded product was the soon-to-expire front month baseload, with a total of 199MW exchanged.

United States

United States Australia

Australia