Posted on: 06/02/2024

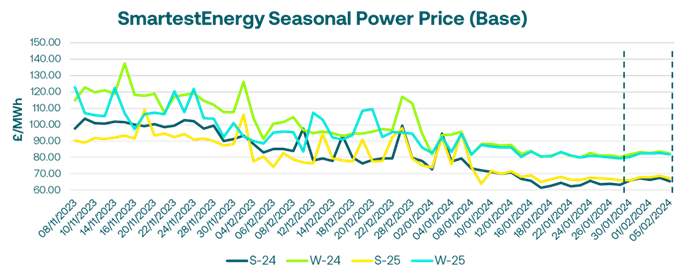

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 30th January – 5th February 2024. On our end-of-day pricing tool, The Source, we published an in-week high of £67.43/MWh for the Summer-24 seasonal power price on 2nd February. In this blog, Fanos shares the market news and updates from the last week.

The UK gas system opened short last Tuesday morning. Overall bearish sentiment in the market was slightly offset by geopolitical tensions affecting LNG deliveries. On the UK power curve, the main interest was on the front season. While Summer-24 gained more than £2MWh, the rest of the curve registered modest gains. Summer-26 traded £0.50 MWh lower than the day before.

The European market initially jumped higher on a cold spell outlook and geopolitical concerns with the ongoing situation in the Middle East, and then eased on Wednesday afternoon. Qatar and US LNG producers are considering swapping cargoes to avoid the severe drought in the Panama Canal and the Houthi attacks in the Red Sea; a US cargo would deliver to a Europe-based Qatar customer while a Qatari cargo would go to an Asia-based US customer. UK Power also jumped higher, pushed by firm gas and emissions. The UK overnight product for Sunday delivery was seen trading as low as £10/MWh as wind generation was expected to reach 14GW and demand is typically low at this period.

On Thursday, the UK gas system was short in the morning. Strong wind output curbed gas for power demand. On the UK power curve more than 170 MW of March traded and seasonal contracts traded as far as Winter-27 with quotes present for Summer-28 and Winter-28. Despite weak fundamentals, thin liquidity and stronger UKA saw power and gas prices firmer the next day.

Prompt UK gas system opened short yesterday morning with lower Langeled flows and higher storage injection nominations. Whilst near term demand is down the week ahead outlook indicates colder temperatures and higher demand. Despite the stronger fundamentals and rising EUA and UKA prices, gas and power forward contracts continued to be sold off with the Q2-24 contract remaining the highest traded period yesterday (Base and Peak).

United States

United States Australia

Australia