Posted on: 12/12/2023

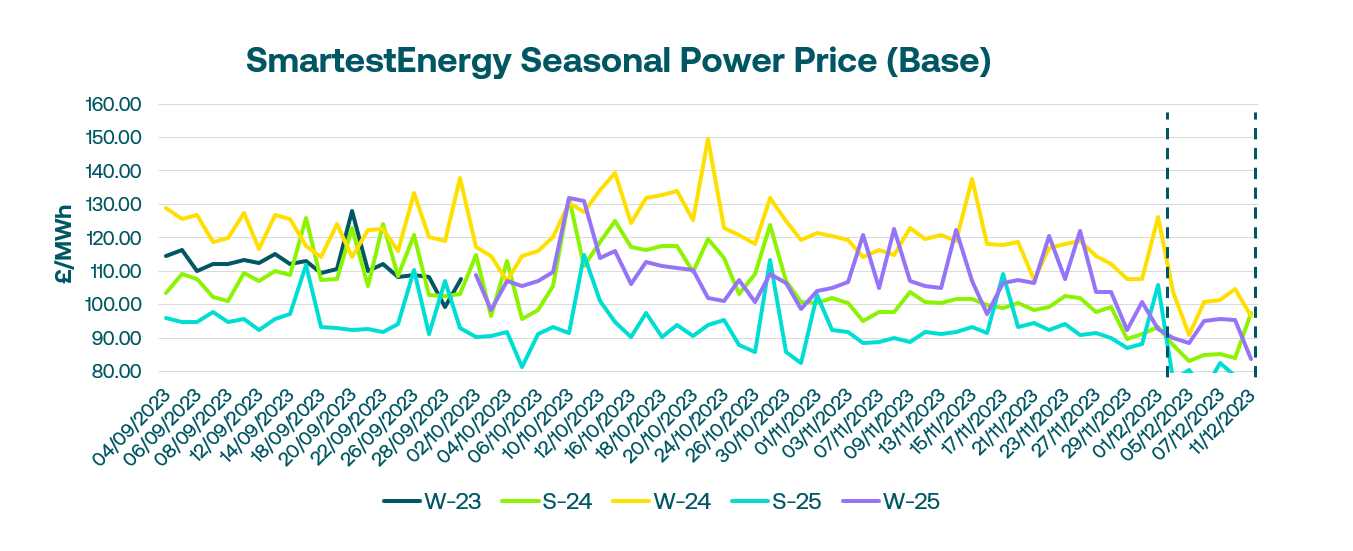

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 5th – 11th December 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £97.50 MWh for the Summer-24 seasonal power price on 11th December. In this blog, Fanos shares the market news and updates from the last week.

Last Tuesday the UK gas system opened well supplied, primarily noted in higher LNG sendout at 103.9mcm/d. Prompt gas prices in turn, softened, compounded by expected warmer temperatures. The NBP and TTF curve had edged down to new lows, leading to a decline in UK Power prices. However, there was limited activity in the mid to far curve as there were few buyers for electricity, resulting in low liquidity.

On Wednesday the gas market experienced a slight technical correction, but the overall sentiment was bearish. Norwegian nominations increased, and the UK gas system was balanced in the morning. Wind output peaked in the afternoon this week. The N2EX DA cleared at £88.25/MWh, marking the lowest price for this month.

Thursday brought mixed signals in fundamentals, with gas supplies seeing only a slight reduction. There was also volatility in short-term wind forecasts, adding some supply risk to power. Demand remained strong with expectations to soften as we moved away from the recent cold spell. The within-day gas system opened 4mcm short. Forward prices appeared to be on a downward trend until Summer-24 dropped below the £85 level. This triggered a late surge of buying into the close. Looking further afield, the LNG price spread between Asia and Europe reached its widest level in almost two years.

European gas began the day with an increase due to short covering last Friday. However, it later declined as the average temperature in Germany was expected to be around 2 degrees Celsius above normal in the following week. This forecast indicated that inventories would remain at a high level, and Norwegian flows were healthy. UK power prices were lower overall due to the bearish trends in gas and carbon. Liquidity was generally low for a Friday, with only the front two seasons showing significant activity.

Yesterday NBP and TTF opened the week with negative trends influenced by bearish fundamentals. The decline was driven by milder weather, strong wind output, and an increase in LNG deliveries. UK power prices dropped by more than £4/MWh. Final tests for the National Grid’s Viking Link interconnector are taking place as the launch date was set for 29th December. This cable connects the UK and Denmark with a capacity of 1.4GW. The commissioning phase for the Sutton Bridge Power Station plant has commenced, and it is expected to resume full operation in April 2024. The 832 MW gas-fired plant was closed in June 2020 when Calon Energy went into administration.

United States

United States Australia

Australia