Posted on: 05/12/2023

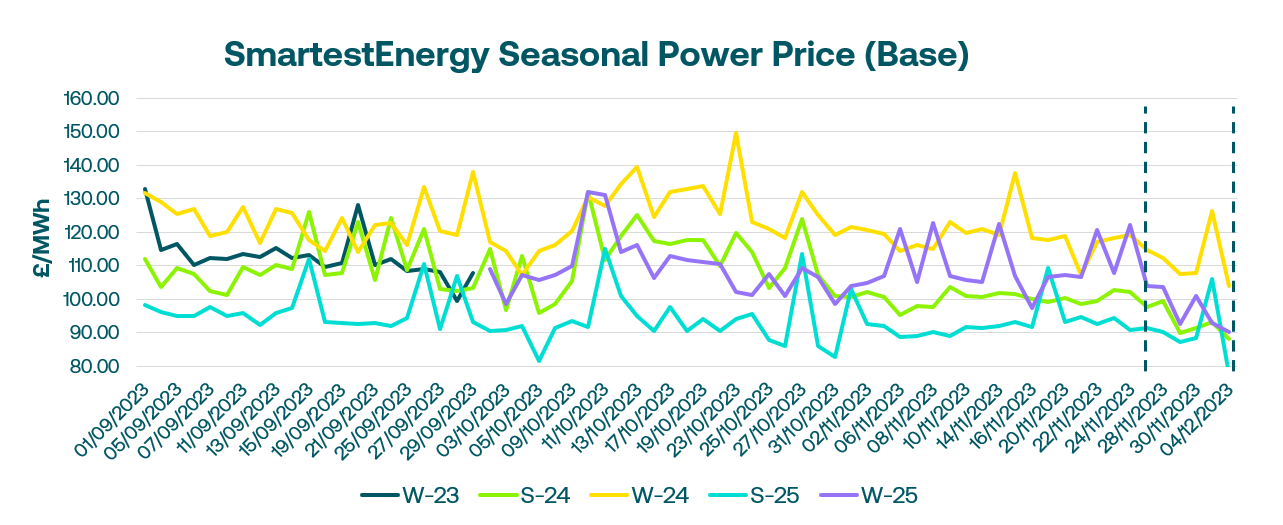

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 28th November – 4th December 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £99.38 MWh for the Summer-24 seasonal power price on 28th November. In this blog, Fanos shares the market news and updates from the last week.

Despite ongoing low temperatures, last Tuesday European gas prices reached a 7-week low due to sufficient gas flows from Norway and comfortable storage levels. The National Grid expected a tight system the following day as a cold spell in Northwest Europe reduced possible electricity imports from the continent. Consequently, the National Grid published a Demand Flexibility Service alert of 550MW between 17:00 and 18:30 on that day. The UK power curve had come off with the December-23 baseload contract, nearing expiry, trading a total of 380MW.

On Wednesday the market continued to soften. The combination of strong supply, reduced demand, and a mild weather forecast for December downward pressure on prices. Storage levels reached record highs. Despite low wind output and cold temperatures pushing prices up in the short term, reaching £205 MWh, and N2EX Day Ahead cleared at £142.74 MWh, while the December-23 baseload slipped to £91.50 MWh.

On 30th November the UK energy system started in balance. The decrease in temperatures was compensated by increased flows from Norway and stronger withdrawals from medium-range storage. European gas prices strengthened from a 7-week low because demand rose during the current cold snap in Northern Europe. Market liquidity was low on curve markets, with only a total of 98 MW of seasonal baseload traded.

Towards the end of the week, both power and gas prices saw increases as forecasts predicted a significant drop in temperatures. The UK experienced an increase in heating demand and the gains were moderated by higher wind generation. The draw on gas storage was notable on the continent, with the UK and Dutch gas prices diverging.

Following a small price rise on Friday, yesterday showed a significant decline. The flow of gas from Norway to the UK increased. The rise in wind output, combined with a mild weather forecast, resulted in a decrease in the demand for gas for power generation. Last week, LNG deliveries to Europe increased, adding further pressure on gas prices. In the UK power market, there was limited buying interest, and more sellers were present.

United States

United States Australia

Australia