Posted on: 23/01/2024

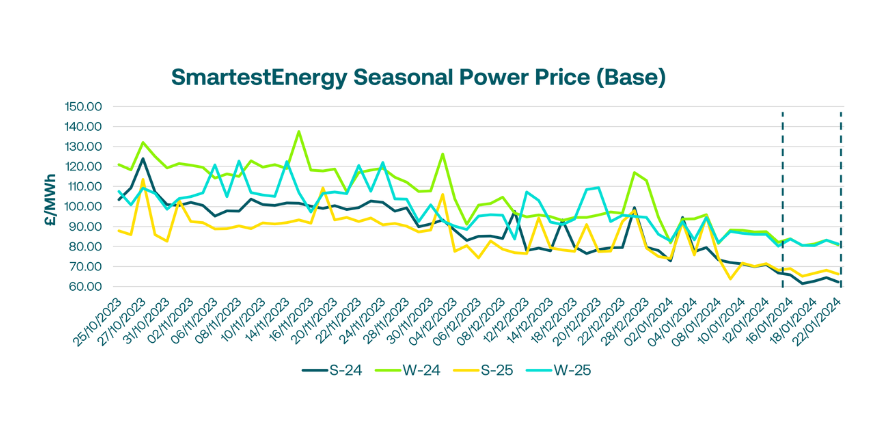

Early last week, UK and European gas fell to a 5-month low, alongside the declining LNG northwest Europe benchmark price, pressured by weak natural gas fundamentals and a well-stocked market, outweighing any Red Sea supply disruption concerns due to the current Suez Canal diversions. The UK power curve was also under pressure, with Winter-24 the most liquid contract, trading a total of 155MW.

On Wednesday, we saw a further decline in the market amid strong supply and weakening demand as temperatures were expected to exceed seasonal averages by more than 4 degrees following the cold spell. Meanwhile, wind output was expected to double over the weekend and LNG deliveries remained stable. On the UK power curve, February-24 was the most popular contract, with almost 500 MW changing hands.

Into the week, UK and European gas recovered slightly as Suez Canal diversions persisted. LNG prices for delivery in Northwest Europe remained at a 7-month low amid robust supply and mild weather forecasts, with the cold snap expected to end at the end of the week. Power also traded higher across the curve, with Feburary-24 once again the most liquid, with a total of 438MW traded.

On Friday, a complex weather outlook made for mixed price signals on gas across Europe and the UK. Near-term demand appeared soft with milder weather expectations, whilst contracts for the month ahead and beyond added value with colder temperatures forecasted.

Power and gas declined further at the start of this week as mild weather persists with above-average temperatures. The UK gas system was slightly short in the morning, whilst in the UK power market, the front-month contract was the most traded, with no interest beyond Winter-25.

United States

United States Australia

Australia