Posted on: 14/03/2023

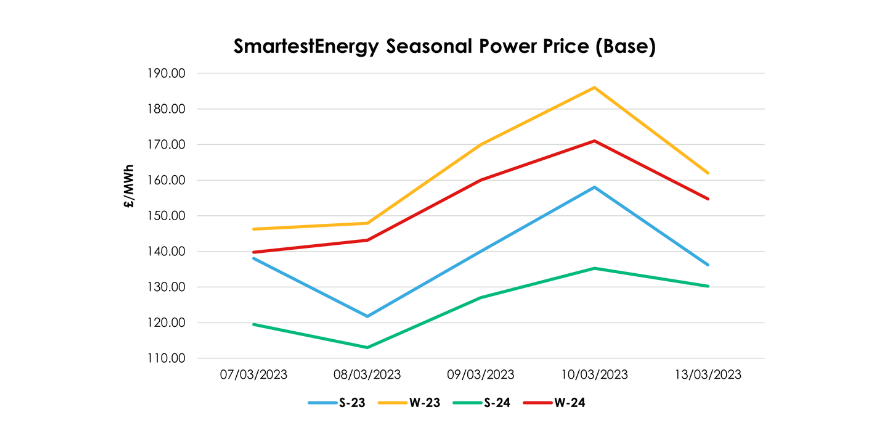

Head of Sales Trading, Fanos Shiamishis, reports on the energy market activity, covering the period 7th – 14th March 2023. On our end-of-day pricing tool, the Source, we published an in-week high of £158.00/MWh for the Summer-23 seasonal power price on 10th March, reducing to £136.20/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Last week, National Grid ESO warmed several coal-fired units in anticipation of a significant increase in demand on the coldest night of the year, with EDF’s West Burton Units 1 & 2 preparing to provide up to 800MW of added supply to the system. Several gas supply risks were noted, with a drop in Norwegian flows and French worker strikes at LNG terminals disrupting gas imports.

Throughout the week, Norwegian flows increased, but this was largely offset by the surge in consumption for heating as the temperature outlook remained cold. Escalating air strikes in and around Kyiv prompted some discussion of further sanctions against Russian Gas shipments, but no firm proposals were reported.

At the end of the week, headlines lifted prices as a major corrosion-related crack was revealed on the Penly 1 nuclear reactor in Normandy. French Union strikes attributed to delays in maintenance work and EDF announced plans to inspect another 200 pipe welds across its 56-nuclear reactor fleet. These delays, coupled with the unconfirmed news reports, saw traders proceed cautiously.

Yesterday, we saw a volatile day in the market as the French strikes continued to impact the energy sector. Meanwhile, mild weather and high renewables output added downward pressure, and relatively high volumes were traded on the UK power curve, with more than 300MW on Winter 23.

United States

United States Australia

Australia