Posted on: 21/03/2023

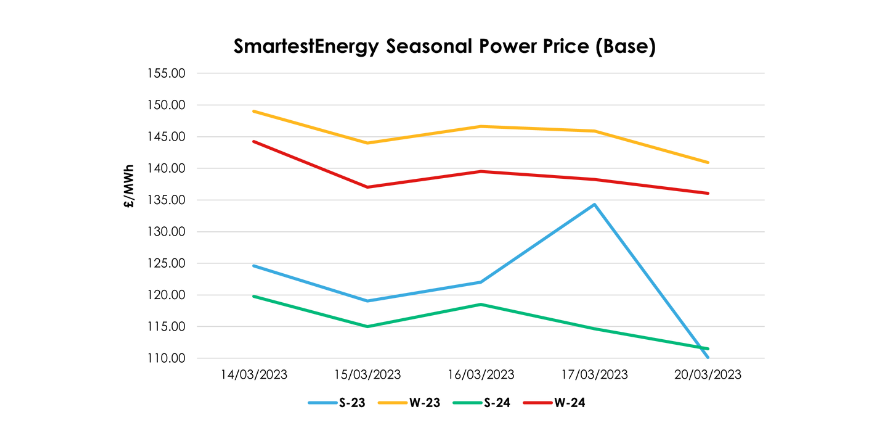

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 14th – 21st March 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £134.27/MWh for the Summer-23 seasonal power price on 17th March, reducing to £110.14/MWh yesterday. In this blog, Fanos shares the market news and updates from the last week.

Last week, European gas prices fell amid mild weather forecasts, strong stock levels and fears of a looming financial crisis following recent banking failures in the US. UK power followed the trend, falling sharply on the back of the soft gas and emissions markets, with baseload products losing at least £5/MWh.

On Wednesday, Chancellor Jeremy Hunt revealed the Spring budget and surprised the industry with a push for nuclear energy investment incentives to match other renewable energy sources. Meanwhile, the UK power curve saw little action and gas prices remained low, facing downward pressure from the mild weather outlook.

As strikes continued across France, LNG send-out remained muted. However, lower demand for gas and stable Norwegian flow outweighed any supply uncertainty. Throughout last week, issues continued to arise at EDF’s French nuclear power plants following the discovery of cracks caused by corrosion. The company is taking steps to minimise the impact as thermal fatigue of the pipes adds to the problem, but more time is required for the maintenance and repair.

Gas prices were down moving into this week, as we saw the major European gas hub TTF registering a 19-month low price for the front-month contract against a backdrop of a US/EU banking crisis and warmer temperatures.

United States

United States Australia

Australia