Posted on: 21/11/2023

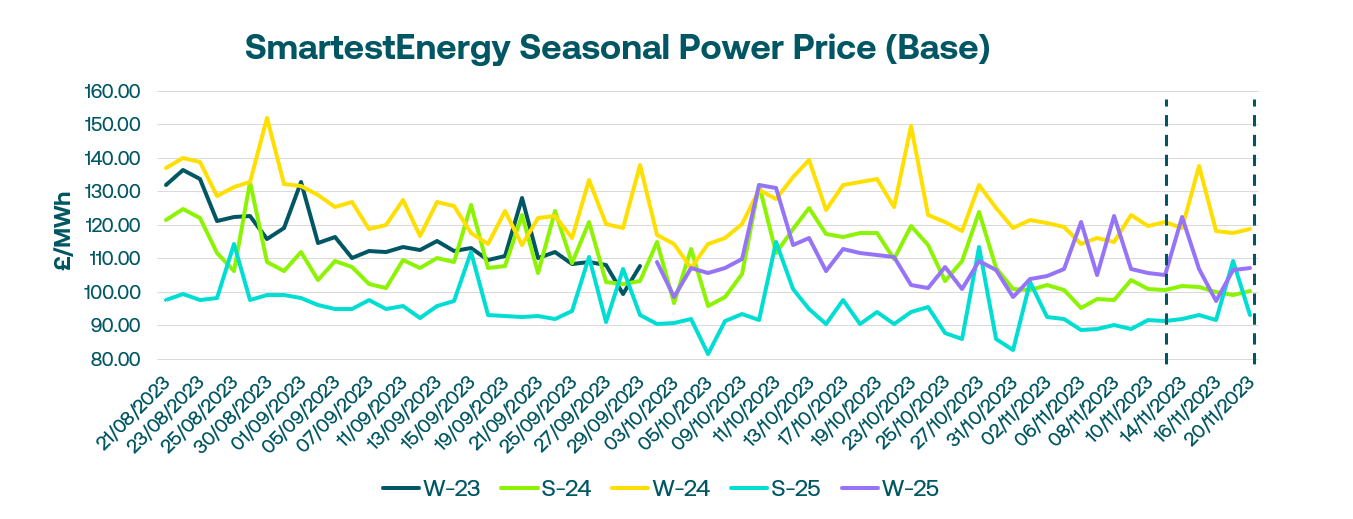

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 14th – 20th November 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £101.75 MWh for the Summer-24 seasonal power price on 14th November. In this blog, Fanos shares the market news and updates from the last week.

At the open last week Tuesday, the UK gas system experienced a shortfall as gas flows to the continent through IUK and BBL saw an increase. BBL resumed exports in anticipation of undergoing maintenance on 16th November. European gas prices dropped due to ample supply, with gas storage at 99.5% capacity and mild temperatures. UK power bounced back as emissions markets recovered, with most liquid UK base products for December-23 and Q1-24 trading at 430 and 266 MW, respectively.

Wednesday morning prices saw an increase due to colder weather and reduced renewables output, but later stabilised thanks to a well-supplied system. The increase in Norwegian flow countered the higher gas demand for power as wind output decreased and was expected to remain low until the weekend. Additional expectations of increased demand for heating were also noted. Limited interest was observed in the UK power curve in the morning, with only Q1-24 trading. However, the situation improved later in the day, with front months Summer-24 and Winter-24 being actively traded. Trading volume remained smaller beyond Winter-24, extending up to Winter-26.

On Thursday morning, the UK gas system opened long as IUK commenced full maintenance until November 30, while BBL exported 5 mcm/d. European gas prices softened due to an increase in supply and a mild weather outlook. The UK gas storage level was at 101.6% which was possible if technical conditions like temperature were optimal or if the calorific value of stored gas was higher. The UK power experienced lower trading, influenced by a bearish gas and emissions market. The front month emerged as the most traded product, with 170 MW exchanged.

Norwegian flow decreased on Friday. An increase in renewable output and milder weather contributed to a slight day-to-day decline in prices. Limited interest was observed on the UK power curve for seasonal products, with only a total of 62 MW being traded. The most actively traded contracts were for December-23 and Q1-24. N2EX DA cleared at 86 £/MWh after two days of clearing above 110 £/MWh.

Yesterday, markets opened with expectations of colder weather persisting throughout the month. Geopolitical concerns heightened after Yemen Houthi rebels seized a cargo ship in the southern Red Sea. Although not an oil or LNG cargo the ongoing tensions in the Middle East have created unease among gas traders.

United States

United States Australia

Australia