Posted on: 28/11/2023

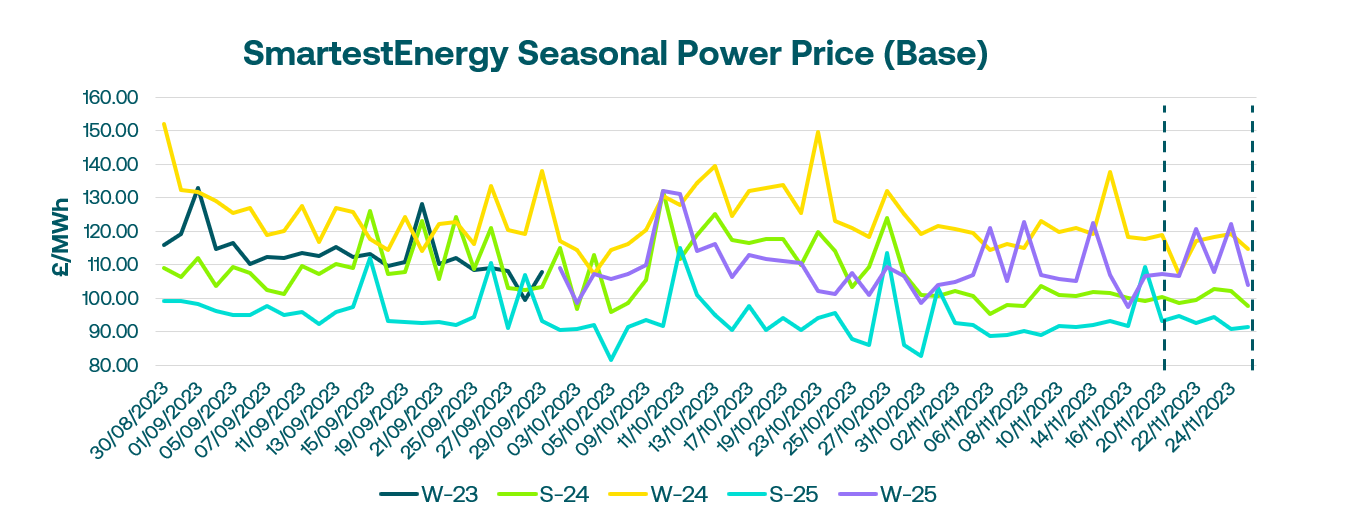

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 21st – 27th November 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £102.74 MWh for the Summer-24 seasonal power price on 23rd November. In this blog, Fanos shares the market news and updates from the last week.

Early last week, amid high storage levels and strong Norwegian flows, we saw continental gas fall to a 6-week low. UK power followed the trend and was also lower across the board, with front month as the most traded product, trading 456MW.

Into the week, Norwegian flows reduced, temperatures continued to cool, and demand for heating increased, adding upward pressure. However, the strong wind output expected over the following days limited the upside.

On Wednesday morning, we saw minimal interest on the UK power curve, with minimal volume trading for December and Q1-24 products changing hands. Trading activity picked up into the afternoon, with trades recorded as far as Winter-26.

On Thursday, the UK gas system opened short due to lower send-out and higher injection into storage. European gas rallied on the back of lower wind generation and cooler-than-normal temperatures expected for the next two weeks. UK power was also firmer, pushed by rising gas and carbon markets.

At the end of the week gas markets for NBP and TTF opened registering losses across the front month out to Winter-24. Despite the latest consumption outlook edging higher on the back of cooler temperatures, the upturn in demand was offset by strong supplies, localised storage and scheduled LNG flows.

Yesterday, the week began with a down day for the energy sector. NBP and TTF eased amid an updated weather forecast for December and a well-supplied system. Meanwhile, higher demand for heating was offset by increased Norwegian flow and stable LNG deliveries. Wind output reached an expected high for the week, above 12 GW, and N2EX DA cleared at the highest price this month, £112.11/MWh. However, as wind output and temperatures are expected to decline, we may see further price increases into the rest of the week.

United States

United States Australia

Australia