Posted on: 18/07/2023

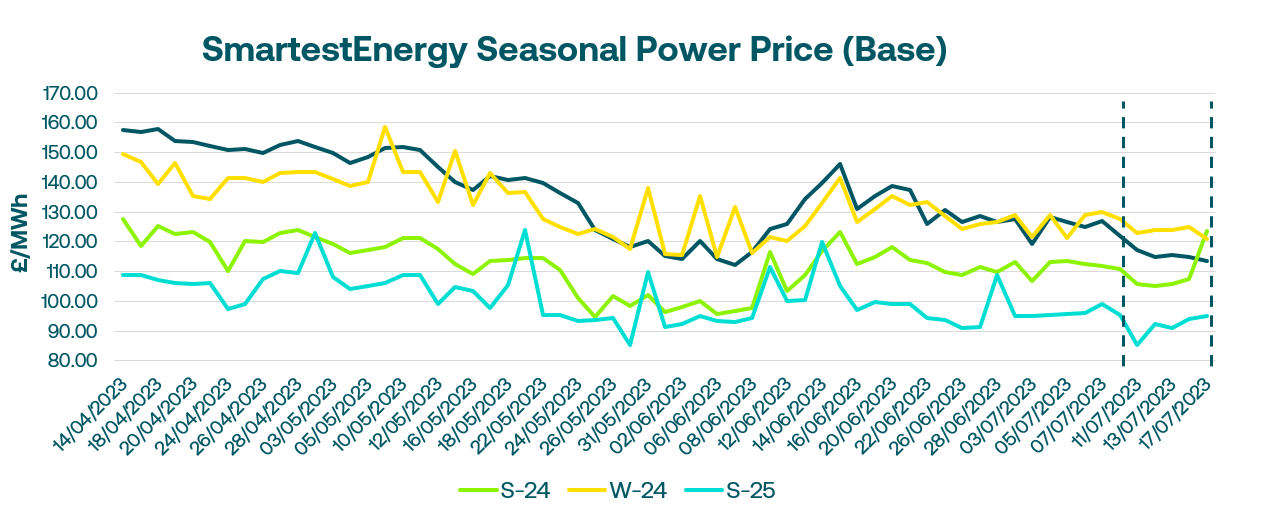

Head of Sales Trading, Fanos Shiamishis, reports on energy market activity, covering the period 11th – 17th July 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £117.38/MWh for the Winter-23 seasonal power price on 11th July. In this blog, Fanos shares the market news and updates from the last week.

Forward prices (out to Winnter-23) continued to decline last Tuesday with the outlook for long-term demand remaining weak, while storage levels were above average and are likely to achieve the required capacity in readiness for October. In the prompt market, the UK system opened 1.6mcm short.

Front month contracts generally maintained stability on Thursday, trading close to Wednesday's closing prices with significant bid interest. Both August and Winter-23 Baseload contracts experienced a modest day-to-day increase. NBP prices closed up for both August and Winter-23, aligning with the trend in TTF prices. Potential risks were identified due to rising river temperatures in France, which could impact the cooling capability of French Nuclear generating plants. However, the solar portfolio's expected supply contributions are anticipated to mitigate any price volatility during the summer. Notably, despite the prominence of news articles regarding river temperatures, there has been no price disruption thus far.

Gas and power prices dropped on Friday afternoon. The UK gas system was slightly long in the morning due to higher flows from the Troll natural gas and oil field in Norway. Trading on the UK power curve was mainly focused on Winter-23 and Q4 2023. With higher wind output over the weekend and mild weather conditions, the N2EX Day Ahead market cleared at a price of £31.75/MWh.

European gas prices dropped to nearly their lowest point in six weeks as Norwegian flows resumed following maintenance at fields and processing plants. Furthermore, LNG imports to Europe have decreased by 5%, as Asia has become the favoured location for flexible cargoes. Notably, the N2EX Day Ahead baseload cleared at a price almost £20/MWh higher due to significant overnight reductions in wind generation.

United States

United States Australia

Australia