Posted on: 26/04/2021

With a reduction to embedded benefits, in line with Ofgem’s Targeted Charging Review (TCR), generator revenue streams have changed significantly over the last couple of years. James Clark, host of our Generator Revenue Streams webinar, provides an overview of the key price changes we forecast for generators and some additional revenue opportunities, since the approval of the P375 code modification.

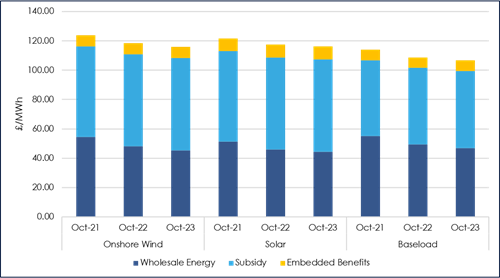

In our Generator Revenue Streams webinar, which took place on the 21st April, I looked at the breakdown of PPA revenues for a low voltage onshore wind, solar or baseload generator for the next 3 years. The total revenue includes 1) wholesale energy, 2) subsidies and 3) embedded benefits. As you can see from the chart below, embedded benefits now only make up a very small proportion of revenue.

Targeted Charging Review (TCR)

The most notable impact of the Targeted Charging Review (TCR) is the removal of BSUoS (Balancing Services Use of System) from the 1st April 2021. For generators in England and Wales this means an estimated £4.90/MWh loss in revenue compared to 2020/21 (for distribution connected generators under 100MW). Generators in North Scotland will however, benefit from this decision as they will no longer have to pay the BSUoS charge, as they were previously.

The real value for generators is via subsidies (ROCs) and wholesale market movements, here are some of the highlights from our pricing experts that we covered in the webinar.

ROC value forecast

Earlier this month Ofgem confirmed the buyout price for the 2021-22 obligation period is £50.80 per ROC. Ofgem update the buyout price annually to reflect the average percentage change month on month in the Retail Prices Index (RPI) during the previous year. We expect inflationary effects from Brexit and the pandemic recovery to pick up and recycle expectations in CP19 remain low due to the reduction in demand from Covid-19, we do however, expect this to normalise in CP20 and beyond.

We have also seen an ad-hoc demand reduction of 3% in the RO % calculation in CP20 which is due to permanent demand erosion.

Wholesale energy overview

Seasonal Prices have steadily increased over the last year, especially during the last lockdown period with Winter 21 reaching £65.80 on the 12th March 2021. In January this year, we saw colder temperatures forecasted with heating demand expected to be higher than seasonal norms across all of Europe, pushing prices up further as the cold snap increased prices at all major European gas hubs. The effects of the Day-Ahead (DA) market and price impact of reduced renewables output added more risk into this summer, which saw support for the Summer 21 contract up to its expiry on the 31st March.

For system prices, over the past year we have seen prices gradually become more volatile due to difficulties in forecasting demand and the increase in intermittent renewable generation on the system. On the 8th January 2021, we saw assets priced as high of £4,000/MWh set the system price for two consecutive periods (19:30 -20:30), with the following period dropping to just £50/MWh. This volatility has led to greater and more regular differences between the N2EX DA Auction prices and system prices.

The Balancing Mechanism and additional Revenue Streams

The Balancing Mechanism (BM) is a near real-time market run by National Grid that corrects the balance in supply and demand. SmartestEnergy has been actively participating in the BM since October 2019 and we manage a growing portfolio of gas peaking and onshore wind assets.

The past year has seen the continued introduction of new entrants into the Balancing Mechanism, which coupled with demand uncertainty, initially applied downward pressure on submitted offer prices. For example, on the 19th April 2020, peak period offer prices for flexible generation assets were as low as £51/MWh (lower than some CCGT offer prices), versus offer prices on the19th April 2021, where the lowest peak period offer for flexible generation was £104.90/MWh.

Our BM assets have performed well against direct competition based on operational parameters. With our highest performing BMU being ‘Smartest DSR (N Wales Mersey)’ ranking 3rd on cashflow/MW, amongst the rest of the BM participants.

What is P375 and what does it mean for smaller generators?

The P375 modification, proposed initially by industry body, Elexon will allow individual asset meters to be used for settlement purposes.

Currently asset meters located "behind the boundary point", where sites connect to a distribution network, are not usually recognised in settlement. However, since Ofgem approved P375 on the 24th February 2021, individual asset meters can be used for settlement from June 2022. This will allow smaller asset owners, such as storage and renewable generation at multi-use sites to provide balancing services and access attractive revenue streams.

As we move into a subsidy-free world, we are seeing generators considering alternative PPA structures, such as Flexible PPAs to fully maximise the value in the wholesale market, or secure long-term price security with a Corporate PPA. Generation assets that can also build flexibility into their output can tap into additional revenue streams like the Balancing Mechanism and other grid services to help increase the returns from their projects.

United States

United States Australia

Australia