Posted on: 25/07/2023

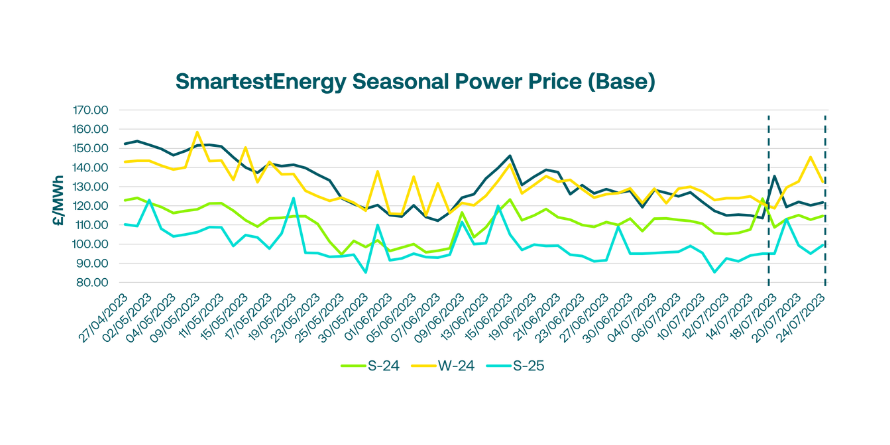

Sales Trader, Jean-Philippe Marty, reports on energy market activity, covering the period 18th – 24th July 2023. On our end-of-day pricing tool, The Source, we published an in-week high of £ 135.50/MWh for the Winter-23 seasonal power price on 18th July. In this blog, Fanos shares the market news and updates from the last week.

Early last week, gas and power prices increased following planned and unplanned outages at Norwegian gas facilities, lower renewable generation output, and higher gas-for-power demand in Southern Europe.

Into the week, UK power continued to trade higher on the back of a strong emissions market. Meanwhile, European gas prices retreated as Norwegian flows resumed and healthy stock levels returned.

In the UK, gas for power demand was up 10mcm day on day to cover the low wind generation, however, this was well covered by strong supply. LNG send-out was low, but, whilst stocks at the three UK terminals sit between 60 and 70%, we do not expect to see any LNG vessels for the rest of the month. UK LNG imports for July-23 are on track to be down 84% year on year, with only US tankers delivering and no Qatar vessels expected.

At the end of the week, further unplanned outages added upward pressure, with the IFA interconnector between the UK and France out until the 21st of July. Although Emissions provided some support, UK Power traded lower across the board due to the soft NBP market in the afternoon.

Yesterday, UK gas prices were expected to rise with increased Norwegian flow. So far, planned outages in Norway in August are offset by healthy storage levels and stable supply. We saw minimal trading interest on the UK power curve, with the front month barely reaching 60 MW and the total volume of the seasonal baseload less than 150MW.

United States

United States Australia

Australia