Posted on: 08/10/2020

Low generation versus high demand on the 15th September caused significant price spikes; with the system price hitting £540/MWh and intraday prices peaking at £753/MWh. Head of Sales Trading, Fanos Shiamishis and Trading Analyst, Leo Burdorf provide an in-depth summary of September’s energy market activity.

Power and Gas:

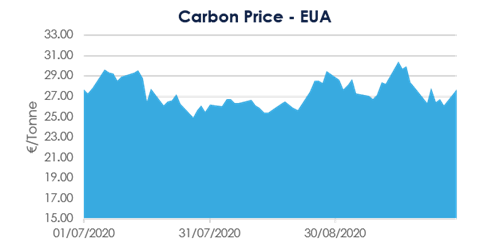

Power and Gas saw significant intra month volatility during September with December EUA approaching €30/Tonne mid-month and driving up Power and Gas prices.

Power and Gas saw significant intra month volatility during September with December EUA approaching €30/Tonne mid-month and driving up Power and Gas prices.

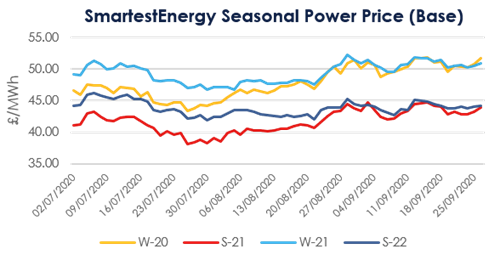

The Winter-20 power contract fluctuated throughout September, opening at £51.50/MWh and hitting an in-month low of £48.82/MWh.

Winter-20 gas has just about gained in value over the past month, now trading at 39.37 pence per therm – a 0.68 pence per therm increase. However, this does represent a bounce back in value from September’s low point of 36.83.

Early weather forecasts outlooks for October were cooler than seasonal norms, whilst further US storm risk supported LNG prices. Low nuclear and wind generation load factor during September also saw ESO committing to warming payments and bringing on several coal units to meet prompt peak demand. Base-Peak price spread widened for the Winter with prompt prices reflective of ESO system balancing actions in the latter half of September.

Coal and oil and coal

Brent Crude is declining overall, trading at $41.96 per barrel after a month in which the commodity opened above $45, fell below $40, and has since stabilised to its current level in the last couple of weeks.

Global oil saw some early gains with storm risks prevailing early in September adding premium to forecasted production. As the risk subsided, price softened with further lockdown/COVID related news compounding the bearish sentiment. Short term stock news and OPEC + commitment to cuts has supported prices throughout the month but overall, weak demand has been the prevailing fundamental driver of September oil prices.

ARA Spot coal has remained stable in value over the course of September. Having started the month at $52.70/tonne, coal has lost 35 cents in value to now trade around $52.35/tonne during a month where the price moved by no more than 50 cents on any given day.

Carbon

Carbon showed some volatility throughout the middle of the month with EUA peaking at €30.44/tonne on 14th September, following a strong rally mid-month with ambitious plans to target deeper emission cuts by 2030. The rally was short lived, and prices have since retracted, EUAs now trade at around €27.69/tonne, only 3 cents below the opening mark for September.

System prices

System prices spiked to £540.22/MWh on the evening of the 15th September, caused by a lack of available generation and high demand across the UK. This is significantly high when you consider that August’s peak was only £97.75/MWh.

With low levels of wind generation throughout Europe, National Grid issued a capacity market notice on September 15th. We also saw the return of negative prices this month, with the minimum system price hitting -£5/MWh.

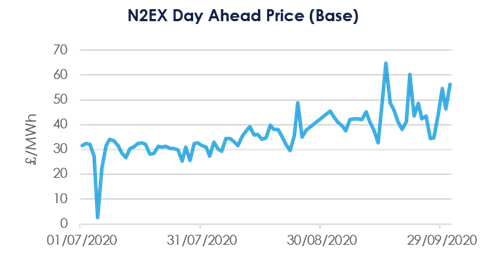

Day Ahead N2EX

Day Ahead N2EX prices (Base) reached the highest prices seen this year at £64.86/MWh on 15th September as markets sought to react to the UK’s need for power. The minimum value was £32.65/MWh, which still represents an increase of £7/MWh month on month for the lowest value.

Intraday prices

On the 15th September, intraday prices hit £753/MWh (6pm) and the next half-hour the price was £659/MWh. This was due to low renewables output across the whole of Europe. France and Germany also had very low renewable output on the day - even lower than forecasted.

The average intraday price was £42/MWh and the average daily spread £74.38/MWh, skewed due to the extremely high price spikes.

Additionally, the French nuclear capacity in September was at a record low compared to previous years due to a maintenance backlog caused by Covid-19 (10GW below the previous year). In Germany, the 15 mins intraday contract went up to €4000/MWh for the evening peak on the 15th September and in France the intraday price went up to €1122/MWh. As a result, the French interconnector was flowing out of the UK in the evening peak. The interconnector usually adds additional capacity, especially in the evening peak when the system is short.

Day-ahead prices

Day-ahead prices also reached new record peaks for this year with seven hourly periods clearing above £100/MWh in September.

We saw a day-ahead price of £187/MWh on the 21st September, which was after the extreme prices seen a few days earlier and this might have been a reaction to the previous event. For the 15th September, the day-ahead price for 6pm was £170/MWh.

Balancing Mechanism (BM)

In the BM we have seen 32.6GWh of offer acceptances for flexible generation, which is less than the record month of August with 52GWh.

BM bid actions for wind generation was 151GWh compared to last month’s 66GWh.

To join our monthly webinars, where we provide an overview of the power markets and a short industry briefing of all the top energy news headlines, please register here.

United States

United States Australia

Australia